Jack’s note:

I was very sick yesterday, and I’m recovering with the help of some of the best doctors in the world. I should be fine in 2-3 days. Sorry for all delays in responses, etc. Thank you for the dozens of amazing emails with prayers, best wishes, and kind words. ❤️

I’m doing the news today.

Thanks to Michael for doing it yesterday!

My new website hub is up at https://www.thestockinsider.com/ (not possible to log in yet)

The main newsletter is now at: https://newsletter.thestockinsider.com/

From now on, links to new tools and all related websites will be appearing on the main domain.

The prices have risen. Bear with me as we get the new Stock Scanner online this week.

Thank you all for supporting me and enabling me to get the “thousands of paid subscribers” badge:

Hi!

It’s Jack and The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 17/100

🔴🔴🔴🔴🔴 — Extreme Fear based on VIX

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Market Indices

Summary: The major US and global market indices are mostly posting modest gains—with the notable exception of the S&P 500 VIX, which is down sharply.

🟢 Dow Jones: Last 40,711.36 | High 40,761.20 | Low 40,458.24 | Change: +186.57 (+0.46%) at 09:55:23

🟢 S&P 500: Last 5,441.50 | High 5,447.50 | Low 5,410.75 | Change: +35.53 (+0.66%) at 09:57:17

🟢 Nasdaq: Last 16,960.32 | High 16,967.05 | Low 16,839.52 | Change: +128.84 (+0.77%) at 09:57:15

🟢 Small Cap 2000: Last 1,900.90 | High 1,902.35 | Low 1,875.90 | Change: +20.02 (+1.06%) at 09:57:16

🔴 S&P 500 VIX: Last 28.41 | High 31.45 | Low 28.29 | Change: -2.47 (-8.00%) at 09:57:16

🟢 S&P/TSX: Last 24,037.23 | High 24,062.54 | Low 23,888.08 | Change: +170.70 (+0.72%) at 09:57:16

🟢 Bovespa: Last 129,653 | High 129,841 | Low 129,286 | Change: +199 (+0.15%) at 09:42:00

🟢 S&P/BMV IPC: Last 52,625.91 | High 52,711.02 | Low 52,259.43 | Change: +234.56 (+0.45%) at 09:57:17

🟢 MSCI World: Last 3,541.68 | High 3,543.60 | Low 3,514.51 | Change: +27.52 (+0.78%) at 09:57:15

🟢 DAX: Last 21,274.82 | High 21,290.70 | Low 21,017.68 | Change: +368.03 (+1.76%) at 09:57:17

🟢 FTSE 100: Last 8,239.11 | High 8,241.06 | Low 8,143.16 | Change: +104.77 (+1.29%) at 09:57:17

🟢 CAC 40: Last 7,331.24 | High 7,331.54 | Low 7,239.73 | Change: +58.12 (+0.80%) at 09:57:15

🟢 Euro Stoxx 50: Last 4,971.65 | High 4,974.05 | Low 4,898.65 | Change: +60.26 (+1.23%) at 09:57:17

Forex & Bonds

Summary: The forex pairs and bonds show a mix of small shifts—with the euro weakening slightly against the dollar, while treasury yields are largely steady or declining very modestly.

🔴 EUR/USD: 1.1313 | Change: -0.0038 (-0.33%)

🟢 USD/JPY: 143.09 | Change: +0.08 (+0.06%)

🟢 GBP/USD: 1.3219 | Change: +0.0030 (+0.23%)

🟢 BTC/USD: 85704.20 | Change: +365.30 (+0.43%)

🔴 5-Year Treasury: 3.991 | Change: -0.007 (-0.18%)

⚪ 10-Year Treasury: 4.364 | Change: 0.00 (0.00%)

🟢 30-Year Treasury: 4.816 | Change: +0.018 (+0.38%)

Major News Stocks

Summary: After the trading bell, top headlines show a wide spread among major stocks, where a few standout winners like BAC and C lead a positive rally, while a couple—particularly BA—are dragging things down.

(Sorted from biggest winners to biggest losers)

🟢 BAC: Change: +4.51%

🟢 C: Change: +2.23%

🟢 AMD: Change: +1.38%

🟢 NVDA: Change: +1.07%

🟢 TTE: Change: +1.04%

🟢 JPM: Change: +0.98%

🟢 TSM: Change: +0.96%

🟢 MSFT: Change: +0.95%

🟢 META: Change: +0.94%

🟢 QQQ: Change: +0.73%

🟢 SPY: Change: +0.55%

🟢 AAPL: Change: +0.16%

⚪ GOOG: Change: -0.04%

⚪ GOOGL: Change: -0.09%

🔴 JNJ: Change: -0.14%

🔴 BA: Change: -0.89%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Beyond the Paywall:

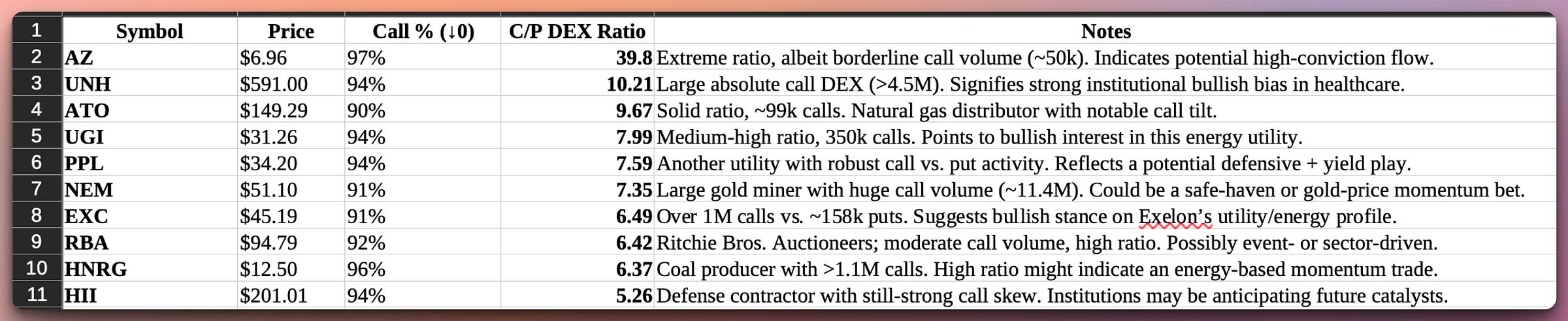

Most Promising Stocks of The Day (from my new revolutionary Quantum Scanner)

Events Affecting The Markets Yesterday, Today & Beyond (with sources)

Most Impactful News Summaries (with links)

Most Promising Stocks to Think About:

Most Interesting Events:

A concise breakdown of key events and developments happening today, Tuesday, April 15, 2025, that might influence the U.S. stock market:

🏦 Major Earnings Reports

Bank of America (BAC)

Reported Q1 earnings per share (EPS) of $0.90 on revenue of $27.37 billion, surpassing expectations.

Stock rose nearly 2% in premarket trading.

Citigroup (C)

Announced a 21% increase in net income to $4.1 billion, with EPS of $1.96, beating the anticipated $1.85.

Equity trading revenue surged 23%, and wealth management revenue hit a record $2.1 billion.

Johnson & Johnson (JNJ)

Exceeded Q1 forecasts with EPS of $2.77 and revenue of $21.89 billion.

Raised full-year sales outlook despite accounting for expected tariff costs.

Other Notable Reports Today

Companies like PNC Financial, Albertsons, Ericsson, and United Airlines are also reporting earnings.

🌐 Trade Policy Developments

Tariff Exemptions and Investigations

President Trump announced temporary exemptions for certain electronics, including Apple products, from new tariffs.

Simultaneously, the administration initiated investigations into imports of pharmaceuticals and semiconductors, signaling potential future tariffs.

China's Response

China instructed its airlines to halt new jet deliveries from Boeing and stop purchasing U.S. parts, citing high costs due to retaliatory tariffs.

📊 Economic Indicators

Import Price Index (March)

Rose by 0.1%, below the forecasted 0.4%, indicating subdued import inflation.

Empire State Manufacturing Survey (April)

Posted a reading of -10.0, better than the expected -20.0, suggesting a less severe contraction in manufacturing activity.

🗣️ Federal Reserve Activity

Upcoming Speeches

Fed Governor Lisa Cook is scheduled to speak at 7:10 PM ET, which might provide insights into the Fed's outlook on monetary policy.

📈 Market Movements

Futures

Dow Jones futures down 0.33%, S&P 500 down 0.28%, and Nasdaq futures down 0.2%, reflecting cautious sentiment amid mixed trade signals.

Sector Highlights

Netflix shares rose over 2% after setting ambitious goals to double revenue by 2030.

Boeing shares fell 3.5% premarket due to China's halt on new jet deliveries.

Sources:

Investopedia - 5 Things to Know Before the Stock Market Opens (April 15, 2025)

MarketWatch - Johnson & Johnson Shares Rise on Q1 Profit Beat

Reuters - US Stock Futures Edge Up on Tariff Exemption Hopes

Most Impactful News Summaries:

China bans airlines from ordering new Boeing aircraft

China has banned its airlines from ordering new Boeing aircraft, a move that could escalate trade tensions with the United States.

The ban, reported by Bloomberg, prevents Chinese airlines from purchasing new Boeing planes and potentially restricts the ordering of parts. This follows existing tariffs imposed by China on US goods.

This action is seen as retaliation in the ongoing trade war initiated by the US, potentially impacting Boeing, a major US employer, and further straining relations.

Source: https://nos.nl/l/2563691

English Source: https://www.forbes.com/sites/siladityaray/2025/04/15/boeing-slumps-in-premarket-as-china-reportedly-moves-to-halt-jet-deliveries/

Microsoft prioritizes AI infrastructure, drops data center deals

Microsoft has withdrawn from two data center deals, reportedly due to concerns about supporting OpenAI's training workloads for ChatGPT. This decision reflects a strategic shift in its AI infrastructure investments.

The company's pullback involves projects in the US and Europe, totaling two gigawatts, as it reevaluates the cost-effectiveness of supporting large language models. Microsoft cited high running costs and increasing competition as factors in its decision.

Despite this, Microsoft remains committed to its $80 billion investment in AI infrastructure, emphasizing continued growth across all regions. Competitors like Meta and Alphabet are stepping up to fill the data center gap.

Trump's tariffs froze the $82B global diamond trade

The global diamond industry, valued at $82 billion, has been severely impacted by former President Trump's tariffs and the resulting trade war, causing a near standstill in trade.

Diamond shipments through Antwerp, a major trading hub, have plummeted to about one-seventh of their usual volume due to the tariffs, which include a 10% levy on diamond imports and potential retaliatory tariffs. The US, a major consumer, imports all its diamonds.

The tariffs, though temporarily paused for some, have created uncertainty, disrupting supply chains and potentially harming the Indian diamond cutting industry and overall consumer demand for luxury goods like diamonds.

Source: https://www.rbc.ua/rus/news/tsila-galuz-vartistyu-80-mlrd-dolariv-zavmerla-1744711836.html

English Source: https://www.reuters.com/markets/commodities/indias-polished-diamond-exports-hit-two-decade-low-industry-group-says-2025-04-14/

First US trade deals will shape market expectations

Market expectations are rising as the US is likely to finalize trade deals, potentially impacting future trade agreements and tariff rates.

JD Vance indicated a US-UK economic agreement is likely, with India also pursuing trade liberalization with the US. The market will watch for the average tariff rate, specifically the 10% level, as a key indicator.

These initial deals could set a benchmark for future agreements, influencing market sentiment and easing concerns about trade wars and potential recession.

Quantum computing threatens XRP security, adoption

The potential threat of quantum computing to XRP's security is a key concern for investors, as it could undermine the blockchain's security and adoption by financial institutions.

Quantum computing's ability to potentially compromise cryptographic security poses a long-term risk to XRP, which is designed for secure financial transactions. Ripple, the company behind XRP, is aware of the threat and monitoring research for quantum-resistant algorithms.

While the risk is not immediate, investors should monitor Ripple's progress in addressing quantum computing threats. The company's proactive approach could enhance XRP's appeal to financial institutions and drive future growth.

Source: https://www.fool.com/investing/2025/04/15/is-this-1-looming-threat-to-xrp-a-reason-to-sell-i/

OpenAI "Stargate" to lead US in AI

OpenAI is launching a $500 billion project, "Stargate," with Oracle and Microsoft, to establish the US as a global AI leader. This initiative aims to create over 100,000 jobs.

The project involves building AI infrastructure, including data centers in Texas, powered by sustainable energy solutions from Crusoe Energy. This collaboration will utilize waste gas from oil wells to generate electricity for the AI systems.

Stargate's development comes amid growing competition from Chinese AI firms and OpenAI's recent launch of GPT-4o and updated models, demonstrating the rapid evolution of AI technology.

U.S. consumers doubt White House's economic optimism

Consumer confidence in the U.S. economy is declining, contradicting the White House's optimistic outlook, according to a recent Federal Reserve survey. This divergence in sentiment is creating uncertainty.

The survey, conducted in March, revealed growing consumer concerns about inflation, unemployment, and the stock market, despite White House officials' reassurances. Markets saw gains on Monday, but those gains may be short-lived.

While markets rose slightly, driven by a tariff exemption, analysts like Morgan Stanley warn investors to remain cautious due to potential economic damage from tariffs. Nvidia plans to build AI infrastructure in the U.S.

Integral Metals advances North American rare earth exploration

China's new rare earth export restrictions have prompted Integral Metals to accelerate exploration at its North American properties. The company aims to reduce reliance on foreign sources.

Integral Metals is focusing on its Woods Creek property in Montana and the Burntwood property in Manitoba, as China's restrictions impact vital elements. These elements are crucial for high-tech and defense applications.

The export controls highlight the need for North American self-sufficiency in rare earth elements. Integral Metals seeks to contribute to a domestic supply chain for these critical minerals.

AI bots drive over half of global internet traffic

AI-powered bots now constitute over half of global internet traffic, according to the 2025 Imperva Bad Bot Report, marking a significant shift in online activity.

Automated traffic, driven by AI, surpassed human activity for the first time in a decade, reaching 51% of all web traffic in 2024. This surge is fueled by the accessibility of AI tools, enabling cyber attackers to create and deploy malicious bots more easily.

The report also highlights a rise in API-directed attacks, with 44% of advanced bot traffic targeting APIs. Industries like finance, healthcare, and e-commerce are particularly vulnerable to these sophisticated bot attacks.

U Mobile partners with Huawei, ZTE for 5G

U Mobile, a Malaysian telecom company, will partner with Huawei and ZTE to build its 5G network, marking Malaysia's second 5G network rollout.

U Mobile secured a government contract and will use infrastructure from the Chinese companies. Huawei will handle the network in Peninsular Malaysia, while ZTE will manage East Malaysia.

This move follows Malaysia's shift to a dual-network model to dismantle monopolies and allow for broader technology participation, including from Huawei, despite some security concerns.

Source: https://ca.news.yahoo.com/malaysia-telco-u-mobile-partner-062209134.html

Chip price doubles by 2030, raising vehicle costs

Semiconductor chip prices are projected to double by 2030, significantly impacting the cost of vehicles, according to a new report. This increase is primarily due to the growing integration of advanced technologies in automobiles.

The report indicates that the cost of chips per vehicle is expected to rise from USD 600 to USD 1,200 by 2030. This surge is driven by the adoption of electric powertrains, smart driving features, and other advanced technologies in modern cars and motorcycles.

The automotive industry's shift towards EVs and smart mobility solutions is fueling the demand for sophisticated semiconductor chips. This trend is reshaping the global manufacturing landscape and increasing the interdependence between the automotive and technology sectors.

Vance sees US, UK reaching trade deal

US Vice President JD Vance stated there's a "good chance" of a trade deal with the UK, amidst global market instability caused by new US tariffs.

Vance said the US is working hard with the UK government on a deal, which would likely encompass goods and services beyond just tariff reductions. This follows President Trump's imposition of tariffs on various countries, including a 10% baseline on UK imports, causing market volatility.

The Vice President also discussed the war in Ukraine, emphasizing the need to understand both sides, and expressed a desire for Europe to strengthen its own defense capabilities.

Source: https://www.bbc.com/news/articles/cly1j4yg872o

Zhipu AI starts IPO process in China

Chinese AI startup Zhipu AI has begun preliminary steps toward an initial public offering, potentially becoming the first of its kind to go public in China.

The company, a Tsinghua University spinoff, is a frontrunner in China's AI sector and has secured state-backed funding. Zhipu AI, developer of the GLM series of language models, claims its flagship model surpasses OpenAI's GPT-4 on some benchmarks.

China International Capital Corporation will sponsor the IPO, a mandatory step in the process. Zhipu AI recently announced it would open-source its GLM series models.

Harvard rejects Trump's demands, loses government funding

Harvard University will lose approximately 2 billion euros in government funding after refusing to comply with demands from the Trump administration. The university's refusal stems from disagreements over campus activism.

The Department of Education's demands include ending diversity programs and banning face masks, often worn by pro-Palestinian protesters. The government also wants Harvard to address antisemitism within its programs. Harvard's director called the demands an infringement on fundamental rights.

The Trump administration has targeted universities like Harvard, citing insufficient action against antisemitism during pro-Palestinian student protests. The university views the government's actions as an overreach into academic freedom.

Source: https://nos.nl/l/2563654

English Source: https://www.yahoo.com/news/harvard-professors-sue-over-trumps-200228008.html

US tariffs cut China's port cargo volume

Chinese port cargo volume has decreased by 10% following the implementation of new US tariffs. This decline reflects the initial impact of the trade measures.

The volume of maritime transport in China dropped by 10% in the week after the tariffs were imposed. From April 29th to May 5th, ports handled 244 million tons of cargo, a 4% decrease compared to the same period in 2024.

This downturn follows tariffs announced by Donald Trump on April 2nd. While air cargo saw a rise, companies exporting to the US now face significant tariffs unless Washington eases the measures.

Source: https://www.kommersant.ru/doc/7657629

English Source: https://www.forexlive.com/news/us-port-import-volumes-set-to-plunge-as-tariffs-bite-20250414/

SpaceX Falcon 9 rocket first stage landed 27 times

A SpaceX Falcon 9 rocket's first stage achieved a new record, becoming the first to launch and land 27 times. This milestone highlights SpaceX's advancements in reusable rocket technology.

The record-breaking launch occurred Monday from Cape Canaveral, successfully deploying 27 Starlink satellites. The rocket's first stage landed on a "droneship" in the Atlantic Ocean, enabling its reuse for future missions.

SpaceX's reusable rocket technology has significantly reduced launch costs. The company aims to apply this technology to its Starship program, potentially enabling frequent flights and missions to the Moon and Mars.

Source: https://www.digitaltrends.com/space/a-spacex-falcon-9-rocket-just-set-a-new-flight-record/

Trade tensions drive U.S. economic uncertainty to new highs

Economic uncertainty in the U.S. is at its highest point in years, fueled by trade tensions and tariff ambiguity, potentially pushing the economy towards a recession.

The Economic Policy Uncertainty index, measuring market and economic instability, surged in March to levels last seen during the COVID-19 pandemic. This uncertainty makes it difficult for businesses and consumers to make decisions, delaying investments and potentially curbing spending.

Experts like Jamie Dimon and Larry Fink have warned that the lack of clarity around tariffs is a significant concern. Even positive news can be overshadowed, as seen with market reactions to inaccurate or quickly-reversed reports.

Source: https://www.nbcnews.com/data-graphics/soaring-uncertainty-means-economy-rcna201201

Wall Street may retest lows before market recovers

Wall Street may need to retest recent lows before a true market bottom is established, according to a Bank of America strategist, despite recent stock gains.

The S&P 500 briefly dipped into negative territory on Monday, reflecting investor unease following a tariff-related sell-off earlier this month, and the index is currently trading about 8% above its April 8 closing low.

Analysts cite historical trends and ongoing economic uncertainties, including tariffs and potential "death cross" formations, as reasons for continued market volatility and caution against overreacting to headlines.

US says Meta illegally monopolized social media

Meta faces an antitrust trial starting Monday, with the U.S. government alleging the company illegally built a social media monopoly. A court ruling against Meta could force the sale of Instagram and WhatsApp.

The government's case centers on Meta's alleged "anticompetitive conduct" over years. Concerns arise over potential political interference from former President Trump, who has a history with Meta's CEO, Mark Zuckerberg.

The trial's outcome could reshape the tech landscape. Trump's past actions and current relationship with Zuckerberg add uncertainty to the proceedings, raising questions about the case's impartiality.

The Trump administration is continuing antitrust efforts against major tech companies, with the FTC and Justice Department pursuing existing lawsuits against Meta and Google, respectively.

These cases, initiated during Trump's first term, allege anti-competitive practices. The FTC is battling Meta over its acquisitions of Instagram and WhatsApp, while the Justice Department seeks to limit Google's search monopoly.

Despite industry hopes for deregulation, Trump's appointees, including the FTC chair, have signaled a commitment to scrutinizing tech giants, and investigations into AI companies like Nvidia and Microsoft are underway.

Secondary Source: http://economictimes.indiatimes.com/tech/technology/what-to-know-about-donald-trumps-antitrust-efforts-against-tech-giants/articleshow/120272560.cms

Government workers accept Trump's second buyout offer

Government workers, facing uncertainty and exhaustion, are accepting a second buyout offer from the Trump administration to reduce the federal workforce. This follows a previous round of buyouts and terminations.

Many federal employees, including a U.S. Army veteran, cited emotional distress and a desire to leave the chaotic environment as reasons for accepting the offer. The buyouts offer paid leave until September 30th.

The buyouts are part of a broader effort to streamline government, but some worry about the legality and funding. Economic uncertainty and pressure tactics are also contributing to the decisions.

Trump administration plans drastic NATO, UN funding cuts

A leaked White House memo reveals a proposal by the Trump administration to drastically cut funding for NATO and the United Nations. This could lead to significant reductions in US financial support for these international bodies.

The memo suggests halving the State Department and USAID budgets, potentially saving the US $27 billion. However, the cuts require Congressional approval, and experts doubt they will be fully implemented, particularly regarding NATO support.

The proposed cuts, if enacted, would likely destabilize the UN, as the US is its largest financial contributor. The proposal has drawn criticism, with some calling it reckless and dangerous, potentially empowering adversaries like China and Russia.

Source: https://www.nrk.no/urix/washington-post_-lekket-notat-viser-plan-om-kutt-til_nato-og-fn-1.17383608

English Source: https://www.nytimes.com/2025/04/14/us/politics/trump-state-department-budget-cuts.html

Share this post