Jack’s note:

The Stock Insider SaaS:

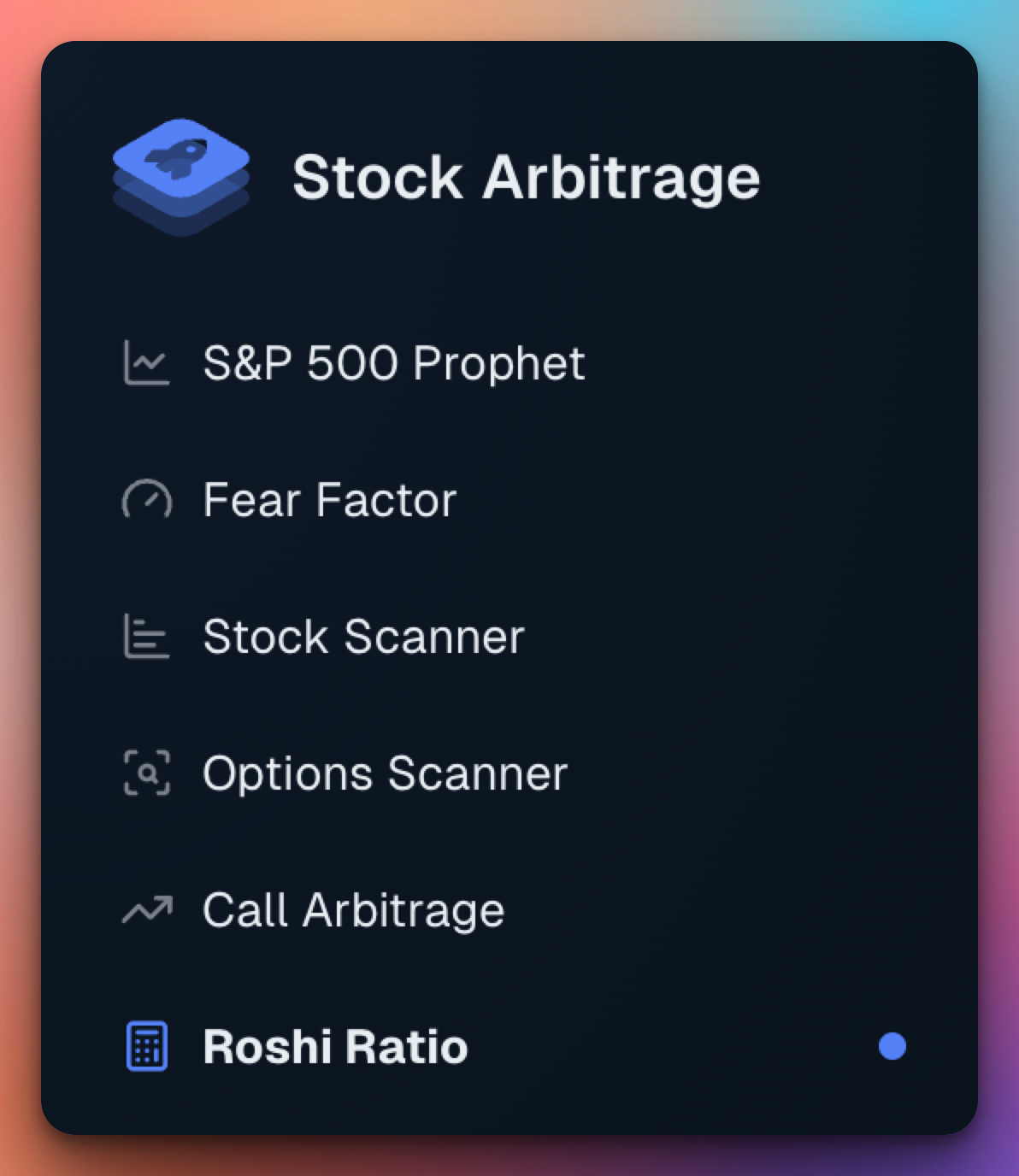

The Stock Arbitrage Scanner is coming out of alpha this week and will be available to all paying and lifetime users.

It will be suitable for both short-, mid- and long-term traders. There will be options too including LEAPs. Everything under 1 roof.

The wait will be worth it.

I will explain more today, including the new Roshi Ratio that I have been working on for months, in today’s Weekly Report.

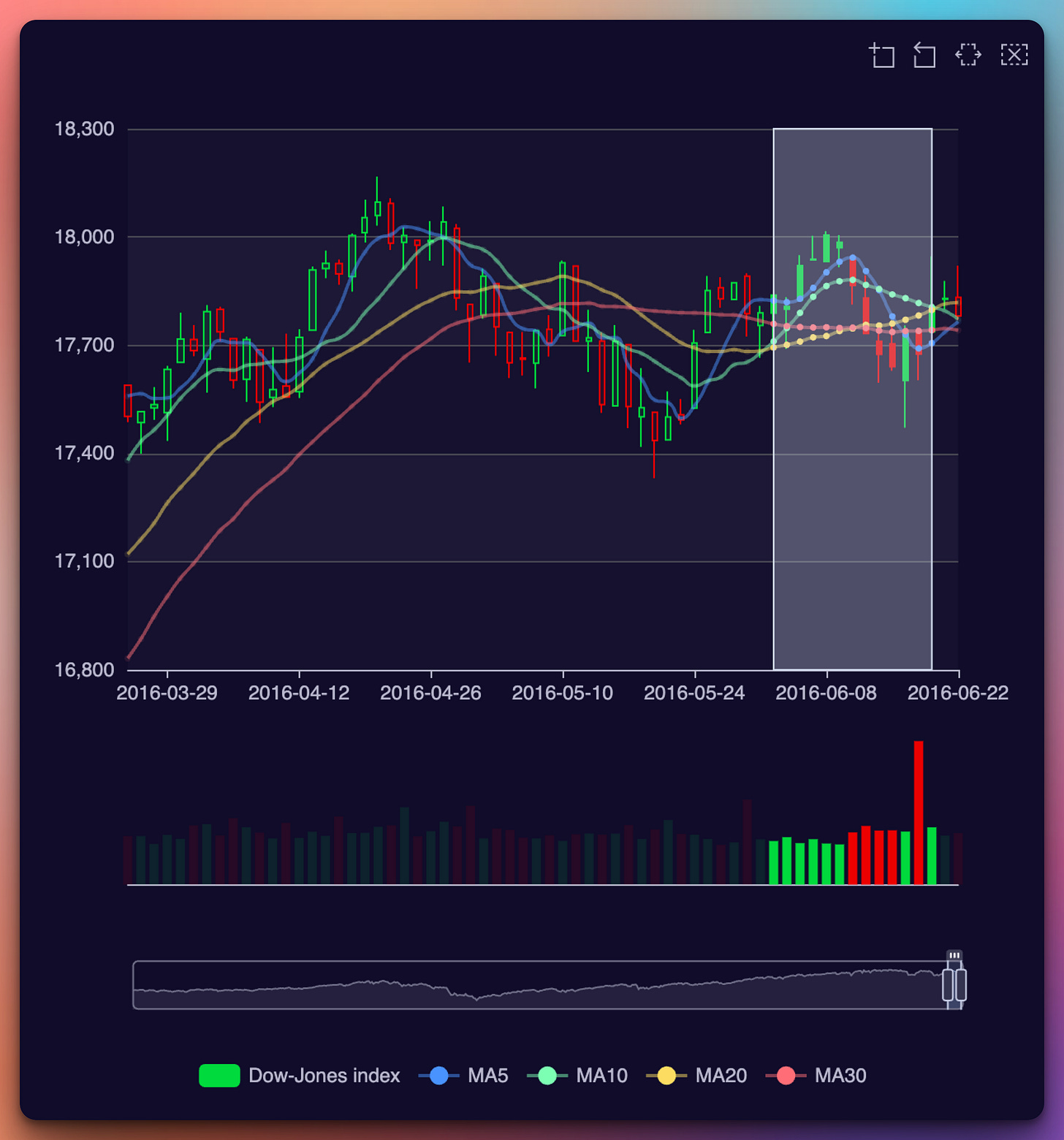

We will have beautiful, interactive charts:

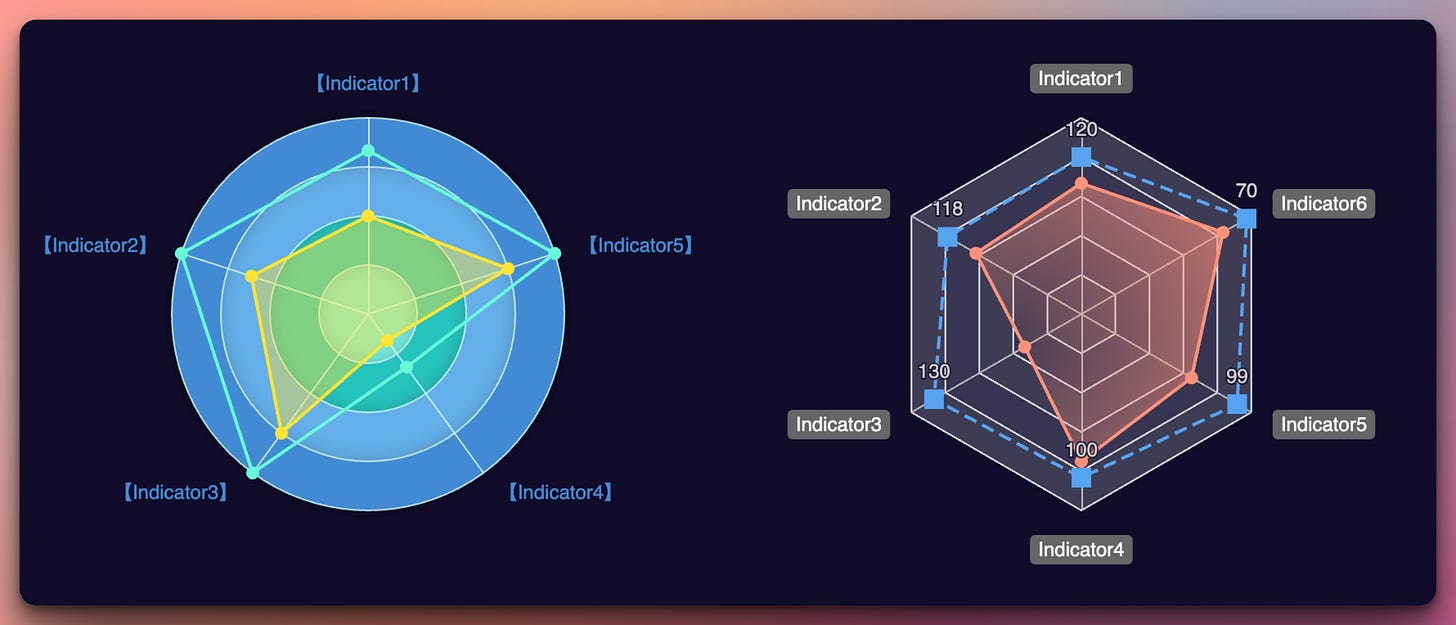

And simple answers for people who don’t want to delve too deep into numbers, candles, and charts:

Lifetime subscriptions are back and, hopefully, here to stay.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 44/100

🟢🟢🟢🔴🔴 — Fear based on VIX

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Market Indices

US benchmarks rallied across the board; small caps outperformed and volatility eased.

🟢 DAX: 23,086.65 (High 23,086.65 | Low 22,764.51) +589.67 (+2.62%)

🟢 Euro Stoxx 50: 5,285.19 (High 5,285.19 | Low 5,201.10) +124.97 (+2.42%)

🟢 CAC 40: 7,770.48 (High 7,779.70 | Low 7,679.01) +176.61 (+2.33%)

🟢 Small Cap 2000: 2,020.74 (High 2,026.53 | Low 1,997.73) +44.88 (+2.27%)

🟢 Nasdaq: 17,977.73 (High 18,048.83 | Low 17,812.04) +266.99 (+1.51%)

🟢 S&P 500: 5,686.67 (High 5,700.70 | Low 5,642.28) +82.53 (+1.47%)

🟢 Dow Jones: 41,317.43 (High 41,386.19 | Low 40,960.42) +564.47 (+1.39%)

🟢 FTSE 100: 8,596.35 (High 8,622.14 | Low 8,496.80) +99.55 (+1.17%)

🟢 S&P/TSX: 25,031.51 (High 25,032.74 | Low 24,861.48) +235.96 (+0.95%)

⚪ MSCI World: 3,724.62 (High 3,726.23 | Low 3,664.64) 0.00 (0.00%)

🔴 S&P/BMV IPC: 55,811.99 (High 56,314.16 | Low 55,468.19) –447.29 (–0.80%)

🔴 Bovespa: 135,134 (High 135,275 | Low 134,355) +67 (+0.05%)

Forex & Bonds

Dollar mixed; US Treasury yields climbed sharply across tenors.

🟢 5-Year Treasury: 3.932 +0.121 (+3.18%)

🟢 10-Year Treasury: 4.322 +0.091 (+2.15%)

🟢 30-Year Treasury: 4.795 +0.058 (+1.22%)

🟢 EUR/USD: 1.1298 +0.0012 (+0.10%)

🔴 USD/JPY: 144.67 –0.29 (–0.20%)

🔴 GBP/USD: 1.3258 –0.0011 (–0.08%)

🔴 BTC/USD: 95,694.00 –6.20 (–0.01%)

Major News

Big tech led gains; Palantir and Meta topped the leaderboard, Apple fell hardest.

🟢 PLTR: +6.95%

🟢 META: +4.34%

🟢 NVDA: +2.59%

🟢 TSLA: +2.38%

🟢 MSFT: +2.32%

🟢 IWM: +2.25%

🟢 GOOG: +1.86%

🟢 BRK-A: +1.75%

🟢 GOOGL: +1.69%

🟢 CVX: +1.64%

🟢 SPY: +1.48%

🟢 QQQ: +1.48%

🟢 SQEW: +1.32%

🟢 XOM: +0.41%

🔴 AMZN: –0.12%

🔴 AAPL: –3.74%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Most Interesting Events:

Summary

OPEC+ ministers might use today’s Joint Ministerial Monitoring Committee to endorse an early 411 kbpd July supply increase and warn that the remaining 2.2 mbpd voluntary cuts could be scrapped by October if compliance stays poor, keeping a lid on crude and headline-inflation expectations.

CME opens Globex at 18:00 ET with wider Nasdaq-100 option strike grids and an expanded 25-month One-Month SOFR futures strip, increasing tail-risk hedging capacity and term-structure depth.

Star Wars Day retail and streaming events push short-run traffic toward DIS, HAS and specialty merchants; LEGO, Amazon and shopDisney run single-day promotions, while Disney+ drops the six-episode “Tales of the Underworld” anthology.

No U.S. data releases, Fed speeches, Treasury auctions or congressional action fall on Sunday; the next bond sales and House/Senate sessions start Monday.

Berkshire Hathaway succession headlines from yesterday’s annual meeting continue to filter through weekend media and analyst notes ahead of Monday’s cash open.

1 OPEC+ virtual JMMC (12:00 GMT)

Draft communiqué outlines an extra 411 kbpd July quota hike and signals readiness to unwind all voluntary cuts by October if laggards fail to curb output.

Kazakhstan’s public resistance to deeper restraint underscores enforcement friction.

Supply-dampened oil keeps WTI/Brent below $65, trimming S&P 500 Energy weighting and softening CPI swap breakevens.

2 CME rule and product changes Effective 18:00 ET Globex open

Strike-price grid revision (SER 9546)

Lowest Nasdaq-100 index-option band tightens to 5 % OTM when 7–10 DTE; deepest band now quotes three rather than two days out.

Market-makers likely quote new far-tail strikes tonight, enlarging delta-hedge flow before Monday’s cash open.

One-Month SOFR strip expansion (SER 9542 + Clearing Advisory 25-157)

Listing horizon doubles to 25 consecutive contract months, flattening the short-rate implied-vol term structure available to banks and mortgage REITs.

3 Consumer catalyst Star Wars Day (May 4)

Retailers run one-day themed SKUs (LEGO Grogu make-and-take, Amazon flash deals, shopDisney Hoth line) that can lift weekend same-store traffic for DIS-linked licenses and hobby channels.

Disney+ premieres “Tales of the Underworld,” adding short-term engagement for DIS’s streaming segment.

4 U.S. policy calendar vacuum

Federal Reserve: Board calendar shows no speeches or releases for May 4 after Governor Cook’s commencement address yesterday.

Treasury: Next coupon/bill auctions begin Monday; no cash-management operations today.

Congress: House marked as district week; Senate in weekend recess.

5 Berkshire-Hathaway governance note

Weekend press amplifies Warren Buffett’s plan to hand the CEO role to Greg Abel at year-end, keeping succession narrative in focus for Monday’s open.

Sources

Beyond the Paywall:

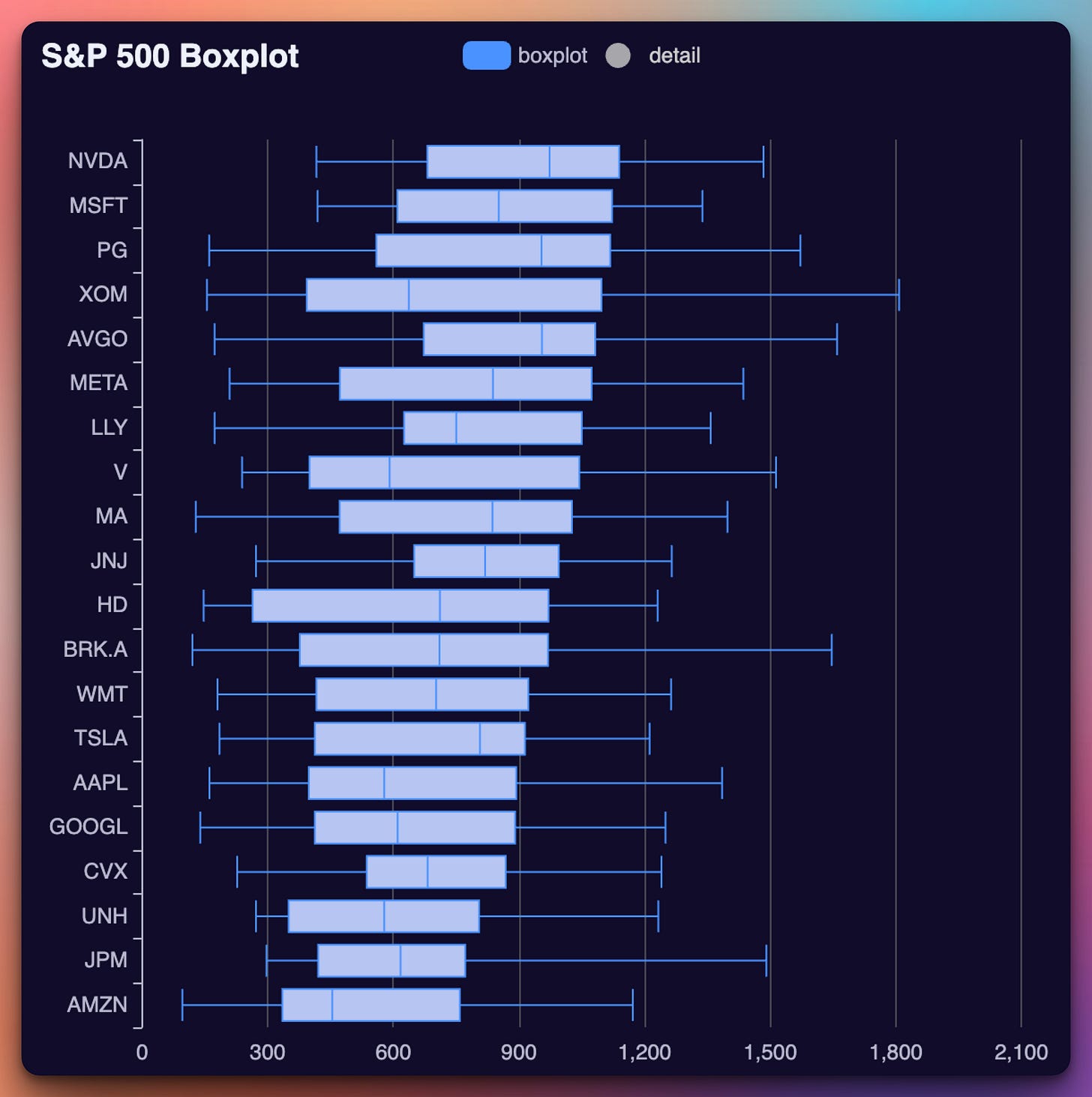

Most Promising Stocks of The Day (from my new revolutionary Stock Arbitrage Scanner, to be public soon)

Most Impactful News Summaries (with sources)

Listen to this episode with a 7-day free trial

Subscribe to Anti-Clickbait News to listen to this post and get 7 days of free access to the full post archives.