Jack’s note:

We are working on weeding out the last bugs and figuring out the polishing touches on the new The Stock Insider SaaS. Please bear with me as I deliver the best product possible without killing myself :)

It will be suitable for both short-, mid- and long-term traders. There will be options too including LEAPs. Everything under 1 roof.

The wait will be worth it.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 34/100

🟢🟢🔴🔴🔴 — Fear based on VIX

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Market Indices

Global benchmarks closed mixed, with U.S. large-caps eking out modest gains while small-caps and select emerging markets underperformed. European markets also edged higher, led by France’s CAC 40 and Germany’s DAX.

🟢 Dow Jones: 40,669.36 (H 40,777.16 | L 39,745.63) +141.74 | +0.35%

🟢 S&P 500: 5,569.06 (H 5,581.84 | L 5,433.24) +8.23 | +0.15%

🔴 Nasdaq: 17,446.34 (H 17,483.82 | L 16,959.53) –14.98 | –0.09%

🔴 Russell 2000: 1,964.12 (H 1,969.40 | L 1,925.35) –12.40 | –0.63%

🔴 S&P 500 VIX: 23.71 (H 24.13 | L 23.67) –0.99 | –4.01%

🔴 S&P/TSX: 24,841.68 (H 24,843.56 | L 24,503.55) –32.80 | –0.13%

🔴 Bovespa: 135,067 (H 135,171 | L 133,955) –26 | –0.02%

🟢 S&P/BMV IPC: 56,259.28 (H 56,336.46 | L 55,241.51) +645.85 | +1.16%

🔴 MSCI World: 3,652.08 (H 3,654.28 | L 3,649.69) –3.44 | –0.09%

🟢 DAX: 22,496.98 (H 22,607.32 | L 22,235.74) +71.15 | +0.32%

🔴 FTSE 100: 8,492.94 (H 8,518.80 | L 8,459.80) –1.91 | –0.02%

🟢 CAC 40: 7,593.87 (H 7,609.32 | L 7,512.23) +38.00 | +0.50%

🔴 Euro Stoxx 50: 5,157.05 (H 5,185.75 | L 5,105.75) –4.85 | –0.09%

Forex & Bonds

The U.S. dollar showed pockets of strength—particularly against the yen—while Treasuries saw modest yield shifts amid a calmer risk tone. Bitcoin outperformed traditional FX, rallying over 1.5%.

🔴 EUR/USD: 1.1324 –0.0004 | –0.04%

🟢 USD/JPY: 144.35 +1.30 | +0.91%

🟢 GBP/USD: 1.3328 +0.0002 | +0.02%

🟢 BTC/USD: 96,208.50 +1,486.10 | +1.57%

🔴 5-Year UST Yield: 3.752% –0.023 | –0.61%

🟢 10-Year UST Yield: 4.177% +0.004 | +0.10%

🟢 30-Year UST Yield: 4.681% +0.033 | +0.71%

Major Movers

Tech names were split, but wide disparities emerged: Western Digital soared nearly 8%, while e-commerce giants and auto makers lagged. Overall, winners outnumbered losers by a narrow margin.

🟢 WDC: +7.98%

🟢 QCOM: +1.08%

🟢 BA: +0.68%

🟢 AAPL: +0.61%

🟢 MSFT: +0.31%

🟢 SPY: +0.04%

🔴 QQQ: –0.01%

🔴 NVDA: –0.09%

🔴 UAL: –0.16%

🔴 HOOD: –0.53%

🔴 META: –0.98%

🔴 F: –1.38%

🔴 AMZN: –1.58%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Most Interesting Events:

TL;DR

On Thursday, May 1 2025, here’s what might move U.S. stocks beyond mere price swings:

Early macro prints on jobless claims, S&P Global/ISM manufacturing PMIs and EIA gas-storage

Treasury auction news and a Fed governor speech, plus end-of-day Fed data releases

A wave of earnings from mega-caps like Apple and Amazon, plus ~80 others

Corporate action quirks (Parks! America split, chatter around an O’Reilly split)

Thinner liquidity as Europe and Asia observe May Day

Below, deep dives on each, followed by linked sources at the bottom.

1. Macro Data Releases

8:30 ET – Weekly Initial Jobless Claims

The Labor Department’s weekly report still might shift Fed-cut odds. A print north of 250 K would lift recession concerns; see also continuing claims for stickiness.9:45 ET – S&P Global Final Manufacturing PMI (Apr.)

S&P’s April final is a last check on factory health; sub-50 shows contraction and might revive recession fears.10:00 ET – ISM Manufacturing PMI (Apr.)

The gold standard on U.S. factories. Watch the new-orders and prices-paid sub-indices for margin and inflation signals.10:30 ET – EIA Weekly Natural Gas Storage

A build over 100 Bcf in shoulder season might push gas prices lower and weigh on utilities and pipelines.

2. Treasury & Fed Flow

≈ 11:30 ET – 26-Week T-Bill Auction Announcement

Surprises in auction size or stop-out rates might tweak term-premium models.14:30 ET – Speech by Fed Gov. Lisa Cook (Pittsburgh)

Any dovish tone after Q1 GDP softness might buoy growth and tech stocks.16:15 ET – Fed H.15 “Selected Interest Rates”

Daily SOFR and UST closes feed discount curves for overnight funding.16:30 ET – Fed H.4.1 “Factors Affecting Reserve Balances”

QT runoff path and RRP usage remain wildcards for liquidity models.

3. Earnings On-Deck

After the Close

Apple (AAPL): iPhone 17 pre-orders, services margin trends

Amazon (AMZN): AWS growth versus retail margin squeeze

Roku (ROKU): Streaming ad-spend trends as a consumer-spend canary

Pre-Market / Morning Calls

Eli Lilly (LLY): Obesity-drug capacity constraints

Mastercard (MA): Cross-border volumes, tariff impacts

McDonald’s (MCD): Traffic and mix in a slowing consumer

CVS, ICE, SO, TRI, APD, BDX: Full pre-market roster

DTE Energy (DTE) (9:00 ET): Regulated-rate pass-through dynamics

4. Corporate Actions & Oddities

Parks! America (PRKA)

Trading on a 1-for-500 reverse split followed by a 5-for-1 forward split could spark liquidity vacuums.O’Reilly Auto Parts (ORLY)

Retail chatter around a potential 15-for-1 forward split keeps flow dynamics active.

5. Global Context: Thin Liquidity

With Europe and most of Asia closed for May Day, U.S. venues will bear the full brunt of any surprise, might leading to exaggerated moves on weak depth.

Sources

Beyond the Paywall:

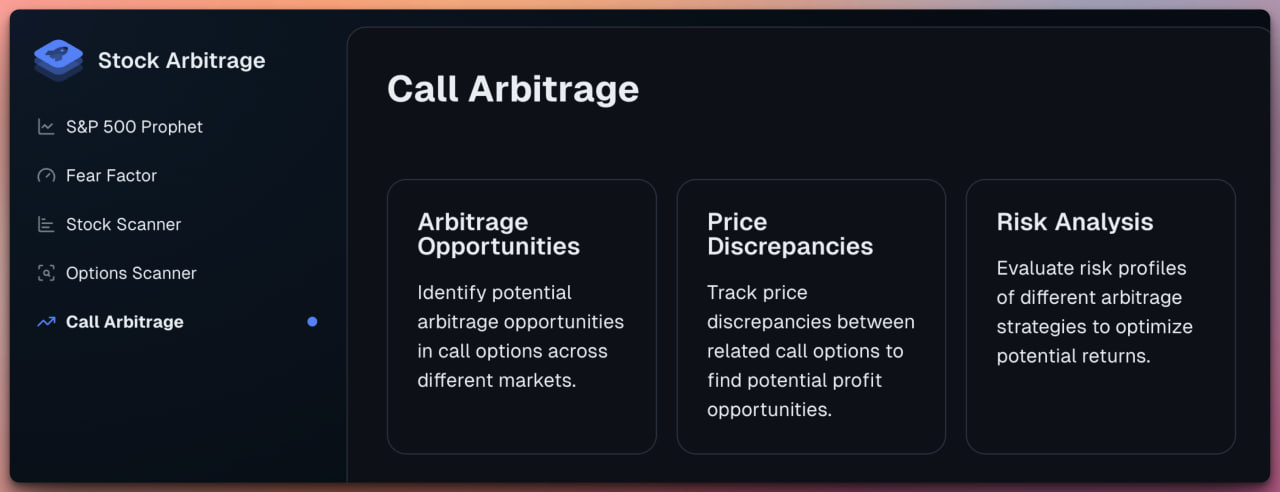

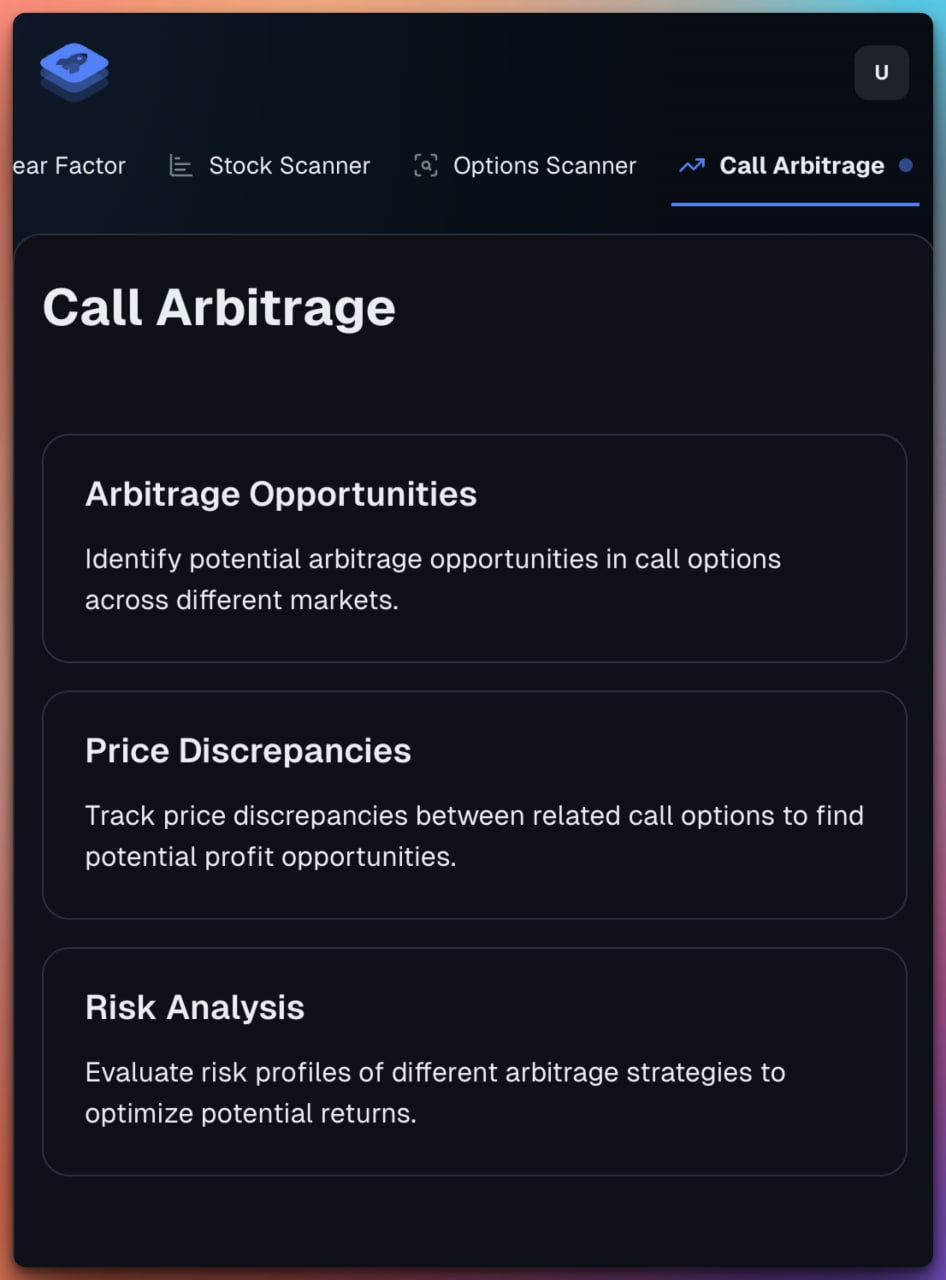

Most Promising Stocks of The Day (from my new revolutionary Stock Arbitrage Scanner, to be public soon)

Most Impactful News Summaries (with sources)

Listen to this episode with a 7-day free trial

Subscribe to Anti-Clickbait News to listen to this post and get 7 days of free access to the full post archives.