Jack’s note:

We are working on weeding out the last bugs and figuring out the polishing touches on the new The Stock Insider SaaS. Please bear with me as I deliver the best product possible without killing myself :)

It will be suitable for both short-, mid- and long-term traders. There will be options too including LEAPs. Everything under 1 roof.

The wait will be worth it.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 41/100

🟢🟢🟢🔴🔴 — Fear based on VIX

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Most Interesting Events:

Today:

Jobs data might shove bonds around at breakfast, Big Oil’s numbers might sway the open, and Buffett’s Omaha carnival will command the weekend narrative. Add two late-day Fed datasets and the usual Friday options fireworks, and the tape could look very different by Monday.

Macroeconomic releases (all times ET)

08 : 30 — April Employment Situation

Payrolls, jobless rate, and wages. A hot print might revive single-cut rate hopes; a miss might deepen recession trades.10 : 00 — March Factory Orders (full M3 report)

Durable-goods déjà vu hints at a rebound, but the full book might expose softer non-defense cap-ex.13 : 00 — Commercial Paper outstanding

A surprise jump in short-term funding demand might re-price credit risk before the close.16 : 15 — Fed H.15 daily rates

Fresh Treasury benchmarks feed straight into swap desks.16 : 15 — Fed H.8 bank balance-sheet update

Another dip in commercial-and-industrial loans would confirm credit tightening and could weigh on cyclicals.

Corporate earnings (before the bell unless noted)

Exxon Mobil — Upstream beat and 20 % Permian volume lift could cushion the energy sector after WTI’s 15 % slide.

Chevron — Adjusted EPS beat but buybacks guided to the low end; retreat might chill the broader “return-of-capital” story.

Shell ADR — $5.6 bn adjusted profit with buybacks intact; ADR volume often leads XLE sentiment.

Cigna — Raises full-year EPS view; strength in pharmacy benefits might buoy managed-care peers after recent cost scares.

Eaton — Outlook trim tied to new tariffs is the latest evidence that industrial margins are feeling the pinch.

Also reporting: Apollo, DuPont, Franklin Resources, T. Rowe, Cboe, ING and others that move second-tier macro levers like flows and cap-ex.

Market mechanics & policy hooks

Weekly SPX / XSP / VIX option expirations

Gamma reset at the open; unwinding might amplify any knee-jerk from the jobs number.Treasury desk

No coupon auctions today; refunding schedule landed Wednesday, so traders may front-run next week’s 3-, 10- and 30-year supply.

The weekend

Berkshire Hathaway mega-meeting (Sat., Omaha)

Doors open 07 : 00 CT, Q&A at 08 : 00. Buffett’s comments on buybacks, cash pile and rates often echo through financials on Monday.Energy backdrop

OPEC+’s eight-country subgroup meets Monday; with no weekend policy decisions due, traders will spend Saturday–Sunday digesting today’s Big Oil earnings.

What will not move the market today

No Fed speeches, no SEC open meetings, no IPO pricings (next deal window opens 6 May). That leaves the spotlight squarely on jobs, Big Oil, and end-of-week gamma flows.

Sources

Beyond the Paywall:

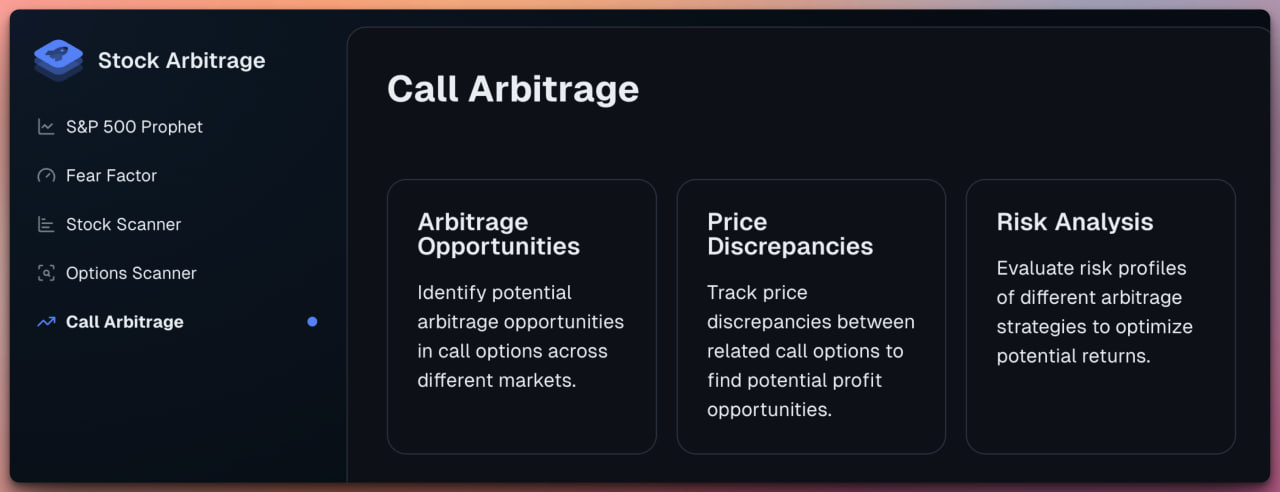

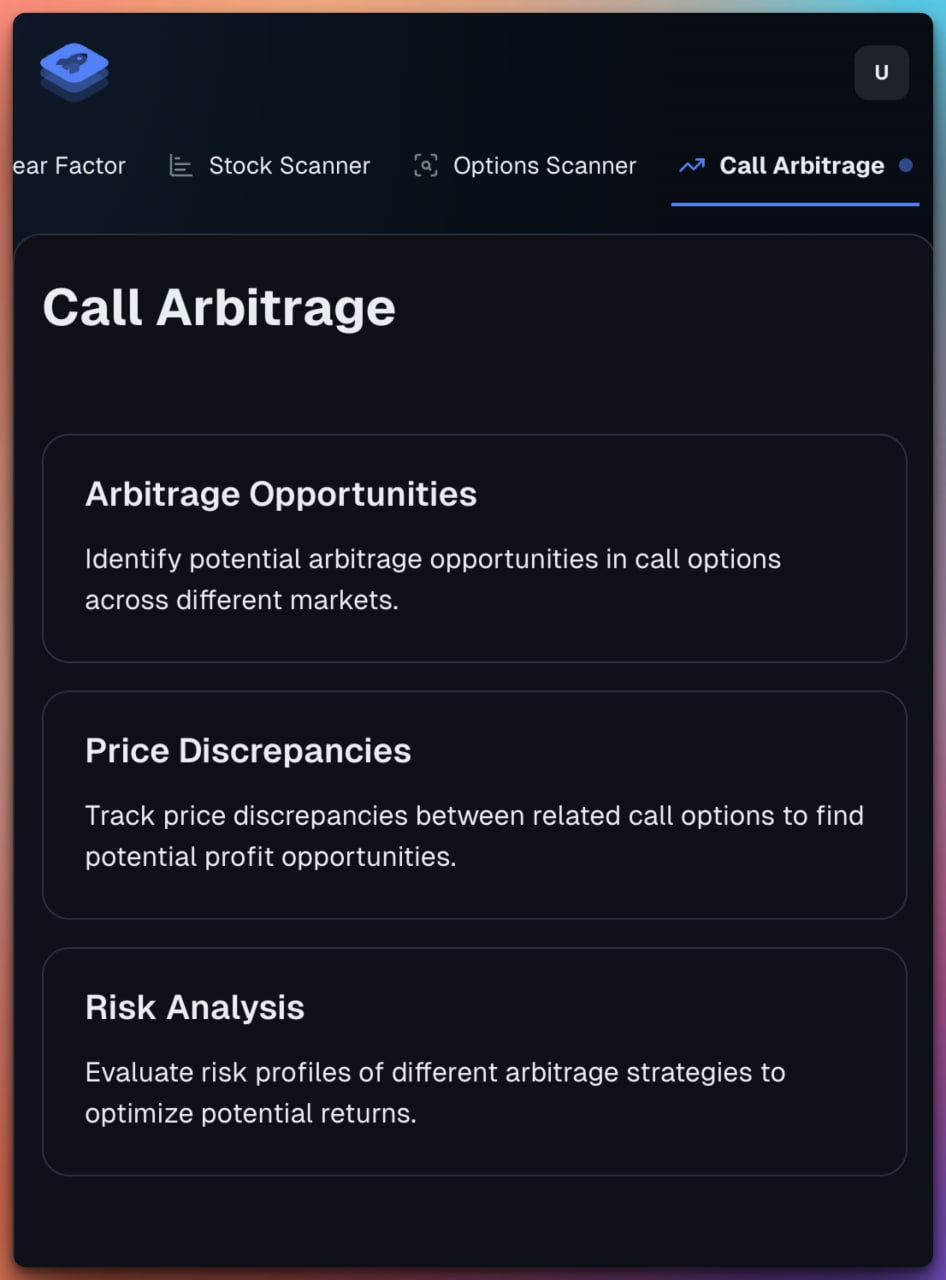

Most Promising Stocks of The Day (from my new revolutionary Stock Arbitrage Scanner, to be public soon)

Most Impactful News Summaries (with sources)

Listen to this episode with a 7-day free trial

Subscribe to Anti-Clickbait News to listen to this post and get 7 days of free access to the full post archives.