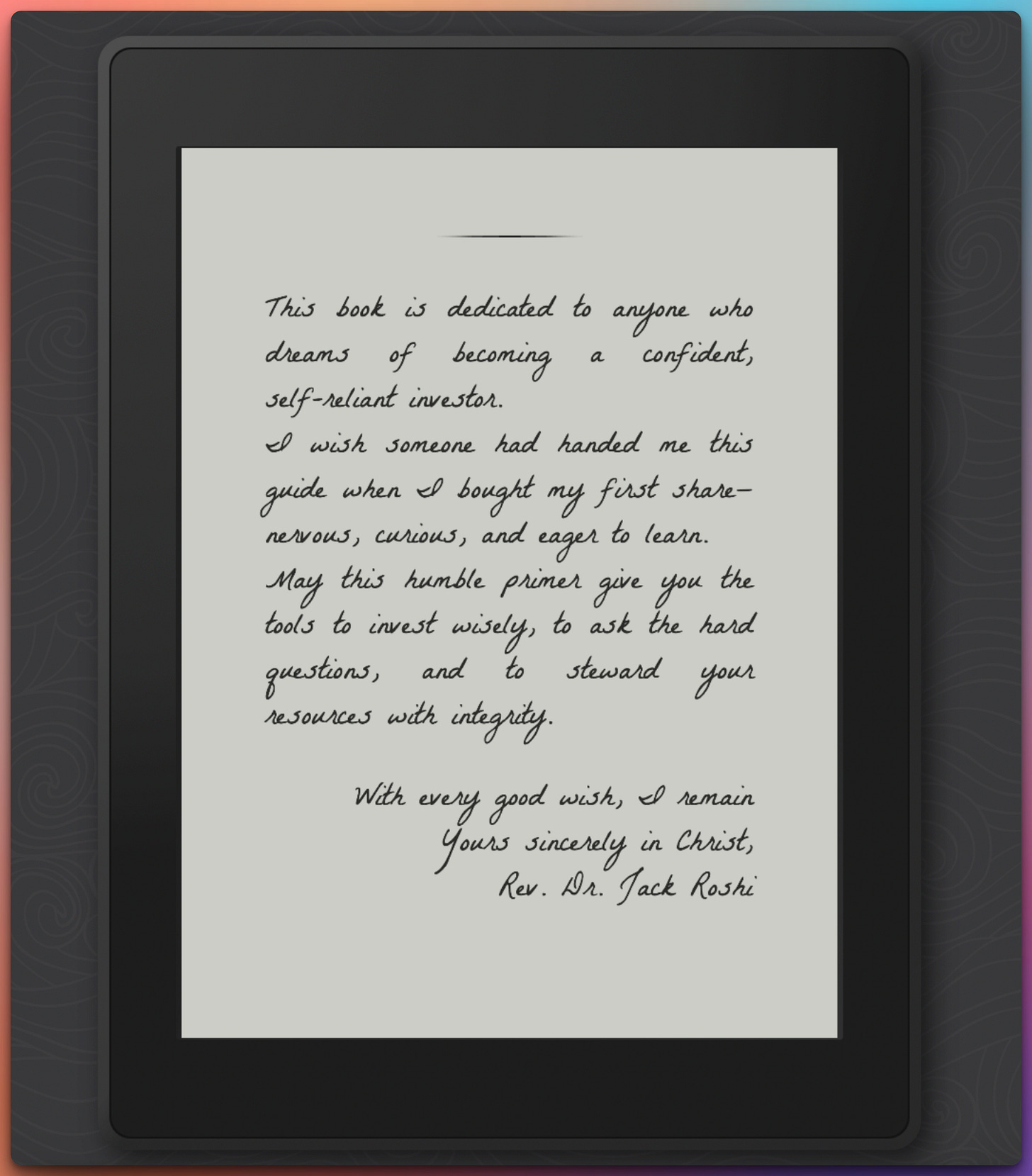

Jack’s note:

I published my first book today in a series of many.

You can download it if you get a subscription to The Stock Insider.

The new Stock Scanner will be online before the end of this week.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 29/100

🟢🔴🔴🔴🔴 — Fear based on VIX (the moods are lifting)

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Market Indices

US benchmarks kicked off the week with solid gains—Nasdaq led the charge, up 2.50%, while European equities struggled and volatility eased marginally. Latin American markets also finished in positive territory.

🟢 Dow Jones: 39,606.57 (+419.59 | +1.07%)

🟢 S&P 500: 5,375.86 (+88.10 | +1.67%)

🟢 Nasdaq: 16,708.05 (+407.63 | +2.50%)

🟢 Small Cap 2000: 1,919.14 (+28.86 | +1.53%)

🔴 S&P 500 VIX: 28.36 (−0.09 | −0.32%)

🟢 S&P/TSX: 24,472.68 (+166.70 | +0.69%)

🟢 Bovespa: 132,216 (+1,752 | +1.34%)

🟢 S&P/BMV IPC: 55,766.58 (+988.74 | +1.80%)

⚪ MSCI World: 3,539.49 (+1.52 | +0.04%)

🔴 DAX: 21,880.39 (−51.80 | −0.24%)

⚪ FTSE 100: 8,389.77 (−13.41 | −0.16%)

🔴 CAC 40: 7,461.26 (−21.10 | −0.28%)

🔴 Euro Stoxx 50: 5,082.05 (−16.69 | −0.33%)

Forex & Bonds

The dollar softened broadly, led by a 0.63% drop against the yen, while euro and sterling both firmed. Short-term Treasury yields climbed further, even as 10- and 30-year rates pulled back slightly.

🟢 EUR/USD: 1.1369 (+0.0055 | +0.49%)

🔴 USD/JPY: 142.49 (−0.90 | −0.63%)

🟢 GBP/USD: 1.3306 (+0.0056 | +0.42%)

⚪ BTC/USD: 92,678.00 (+40.50 | +0.04%)

🟢 5-Year Treasury: 4.014% (+0.037 | +0.93%)

⚪ 10-Year Treasury: 4.387% (−0.002 | −0.05%)

🔴 30-Year Treasury: 4.833% (−0.046 | −0.94%)

Top Movers

Growth and momentum names dominated the leaderboard—ServiceNow surged nearly 6%, while Tesla added over 5%. On the downside, consumer staples and ride-hailing stocks lagged.

🟢 NOW: +5.98%

🟢 TSLA: +5.37%

🟢 AMZN: +4.28%

🟢 META: +4.00%

🟢 NVDA: +3.86%

🟢 GOOGL: +2.56%

🟢 GOOG: +2.48%

🟢 AAPL: +2.43%

🟢 JPM: +2.25%

🟢 CMCSA: +0.79%

🟢 ADBE: +0.59%

⚪ WMT: +0.12%

🔴 PEP: −0.84%

🔴 UBER: −0.90%

🔴 PG: −1.28%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Beyond the Paywall:

Most Promising Stocks of The Day (from my new revolutionary Quantum Scanner)

Events Affecting The Markets Yesterday, Today & Beyond (with sources)

Most Impactful News Summaries (with links)

Listen to this episode with a 7-day free trial

Subscribe to Anti-Clickbait News to listen to this post and get 7 days of free access to the full post archives.