Jack’s note:

The Stock Arbitrage Scanner is now available to all subscribers of the The Stock Insider Newsletter.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 62/100

🟢🟢🟢🟢🔴 — Market is greedy

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.📈 US & Global Indexes

Markets closed mixed. US indexes showed minor declines, while European markets advanced. Volatility slightly eased with the VIX down nearly 3%.

🔴 Dow Jones: 41,249.38 (-119.07 | -0.29%)

⚪ S&P 500: 5,659.91 (-4.03 | -0.07%)

⚪ Nasdaq: 17,928.92 (+0.78 | 0.00%)

🔴 Russell 2000: 2,023.07 (-3.34 | -0.16%)

🟢 S&P/TSX: 25,357.74 (+103.68 | +0.41%)

🟢 Bovespa: 136,512 (+280 | +0.21%)

🔴 S&P/BMV IPC: 56,551.18 (-315.58 | -0.55%)

⚪ MSCI World: 3,711.68 (+3.79 | +0.10%)

🟢 DAX: 23,499.32 (+146.63 | +0.63%)

🟢 FTSE 100: 8,554.80 (+23.19 | +0.27%)

🟢 CAC 40: 7,743.75 (+49.31 | +0.64%)

🟢 Euro Stoxx 50: 5,310.95 (+22.01 | +0.42%)

🔴 VIX: 21.90 (-0.58 | -2.58%)

💱 Forex & Bond Market

Dollar weakened slightly against major currencies. GBP saw strong gains. Treasury yields were largely flat with minimal moves across the curve.

⚪ EUR/USD: 1.1246 (+0.0021 | +0.19%)

🔴 USD/JPY: 145.37 (-0.53 | -0.36%)

🟢 GBP/USD: 1.3306 (+0.0063 | +0.48%)

🟢 BTC/USD: 103,490.00 (+290.00 | +0.28%)

🔴 5-Year Treasury: 3.987 (-0.007 | -0.18%)

⚪ 10-Year Treasury: 4.375 (+0.002 | +0.05%)

🔴 30-Year Treasury: 4.833 (-0.003 | -0.06%)

📊 Major Stock Movers

Mixed corporate action today. LYFT and PODD surged post-earnings, while AFRM and EXPE tumbled. Semis saw divergence with MCHP rallying and NVDA slipping.

🟢 PODD: +20.88%

🟢 LYFT: +28.08%

🟢 MCHP: +12.60%

🟢 NET: +6.46%

🟢 TSLA: +4.72%

🟢 DKNG: +2.49%

🟢 AAPL: +0.53%

🟢 AMZN: +0.51%

🟢 MSFT: +0.13%

🔴 GOOGL: -0.99%

🔴 GOOG: -0.88%

🔴 NVDA: -0.61%

🔴 PLTR: -1.55%

🔴 COIN: -3.48%

🔴 EXPE: -7.30%

🔴 AFRM: -14.47%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Most Interesting Events:

Key take-aways

• Immigration order for voluntary cash-back “self-deportation” might tighten low-wage labor supply and consumption.

• VA directive to house 6 000 homeless veterans on the West L.A. campus shifts Federal outlays into regional construction and REIT flows.

• National Small Business Week and Hurricane Preparedness Week proclamations expire at midnight, ending time-boxed grant and procurement windows.

• Trade headlines today signal selective tariff roll-backs and U.S.–China talks in Geneva; policy direction remains unstable.

• Richmond Fed’s weekend remarks highlight slowing activity but no rate-cut support, setting up a potential Monday repricing of terminal-rate odds.

• Commerce’s Section 232 steel–aluminum “inclusion” process hits its statutory deadline today, capping new duty-free claims.

• SEC Saturday docket features the Canary Litecoin ETF proceeding—crypto-proxy equities will trade the news flow.

• Weekend corporate tape: Nine Energy Service Q1 transcript, Live Ventures Q2 call, byNordic SPAC deadline extension, Susquehanna Community Bank merger.

• Real-time catalysts before Monday’s open: Altimmune poster at EASL (obesity-liver read-through), Chinese Antibody Society Boston meeting (ADC / bispecific focus), CryptoAI Summit NYC, Amsterdam Crypto Conference.

Federal policy actions today

Immigration executive order – “Project Homecoming” launches cash-stipend voluntary departures for undocumented migrants, booked through the CBP Home app. Labor-market participation and service-sector wage trajectories could shift if uptake is large.

Veteran housing directive instructs the VA and HUD to begin rehousing up to 6 000 veterans on the West L.A. campus, reallocating funds previously earmarked for migrant services. Construction contractors and SoCal REITs stand to benefit.

Proclamations ending at midnight: National Small Business Week and National Hurricane Preparedness Week. The SBA grant window and FEMA procurement fast-track both close once the proclamations lapse.

Trade & monetary backdrop

Guardian analysis and Reuters Geneva coverage indicate the administration might ease selected tariffs as part of a mini-deal with the U.K. and exploratory talks with China. Direction remains volatile.

Richmond Fed President Barkin today likens business conditions to “driving in fog,” warning of weaker activity while refusing to back near-term cuts. Watch CME Fed-funds futures Sunday evening.

Regulatory deadlines today

All day — Final statutory day for Commerce to complete the Section 232 steel/aluminum tariff-inclusion process; manufacturers awaiting duty relief get clarity.

08:00 ET — SEC public-inspection feed posts Saturday filings; headline item is the Nasdaq Canary Litecoin ETF order instituting proceedings.

Corporate disclosures hitting the tape

Nine Energy Service Q1 transcript (margin miss, revenue beat) informs small-cap oil-field-service models.

Live Ventures Q2 call emphasizes credit-cost containment, relevant for micro-cap consumer lenders.

byNordic Acquisition Corp deposits cash to extend its SPAC deadline, preserving $200 million for Nordic fintech targets.

Susquehanna Community Bank → Citizens & Northern weekend merger creates a $3.2 billion regional lender, raising M&A comps in PA community banking.

Conferences & data releases underway

Altimmune poster session, EASL Congress, Amsterdam (12:00–13:00 CEST) — MASLD efficacy data could move ALT and peer obesity-liver pipelines.

Chinese Antibody Society annual meeting, Boston (08:30 ET start) — Updates on bispecifics and ADCs set the narrative for large-cap oncology names.

CryptoAI Summit, New York City (all day) — Retail flow into AI-linked tokens and listed miners.

Amsterdam Cryptocurrency Conference (May 10-11) — Weekend volatility in BTC and ETH often tracks European conference headlines.

Watch-list into Monday

Model labor-supply changes and regional spending from the immigration and veteran-housing orders.

Update duty-relief scenarios after the Section 232 deadline.

Monitor SEC docket in case of surprise action on the Litecoin ETF.

Re-rate small-cap energy and community-bank screens post-weekend disclosures.

Sources

DHS press release – Voluntary self-deportation travel assistance

Reuters – U.S. offers $1 000 stipend for migrants who self-deport

Los Angeles Times – Order to house 6 000 veterans at West L.A. VA

White House fact sheet – Center for Homeless Veterans directive

White House proclamation – National Small Business Week 2025

White House proclamation – National Hurricane Preparedness Week 2025

Federal Register – Section 232 steel & aluminum inclusion process deadline

Sun-Gazette – Susquehanna Community Bank merging into Citizens & Northern

Beyond the Paywall:

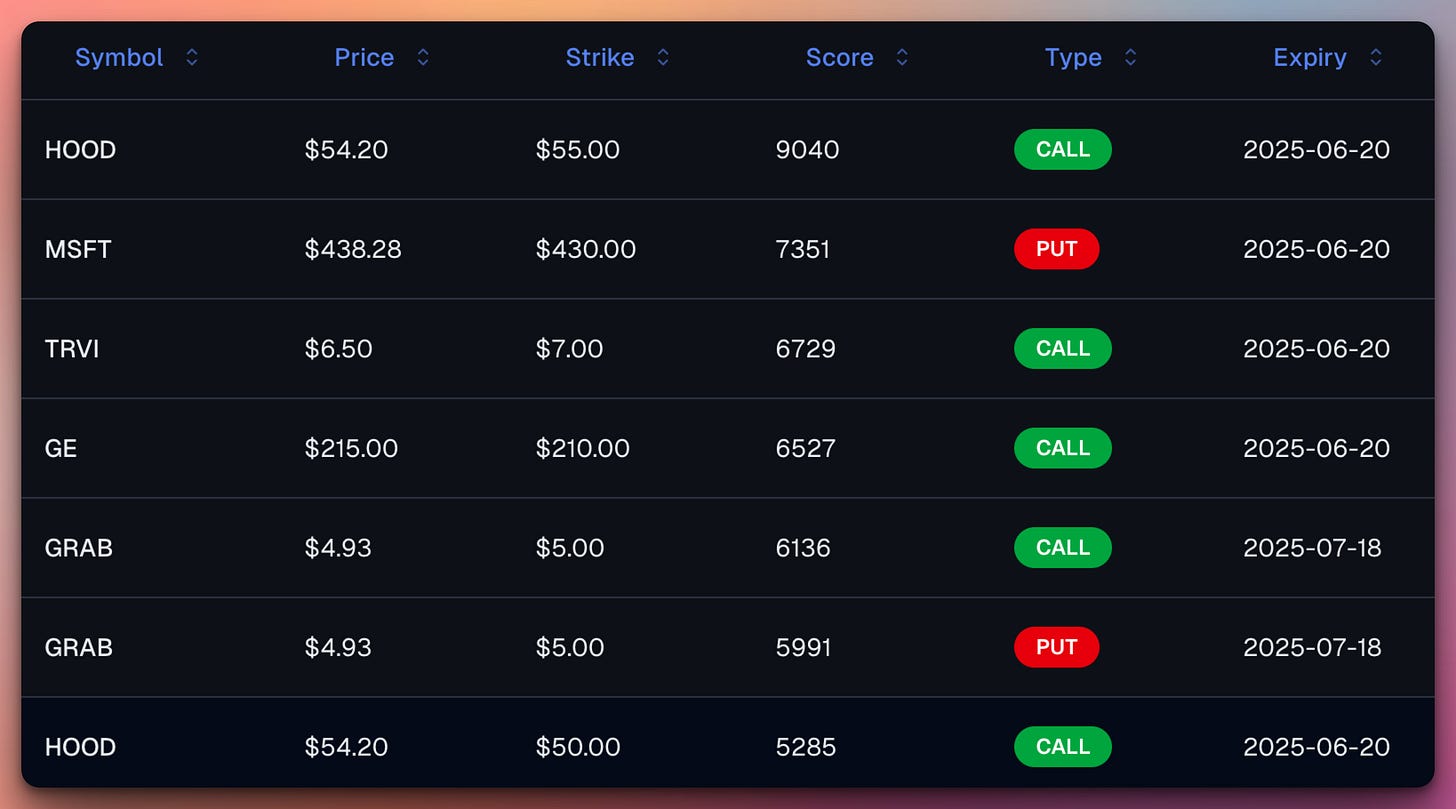

Most Promising Stocks of The Day (from my new revolutionary Stock Arbitrage Scanner, available to the public now)

Most Impactful News Summaries (with sources)

Most Promising Stocks to Think About:

From StockArbitrage.com, 1 time I’m posting the best ones for free:

Most Impactful News Summaries:

NSO Group hacked WhatsApp users, jury says

A jury ordered NSO Group to pay WhatsApp over $167 million in damages, concluding a five-year legal battle over spyware used to hack WhatsApp users.

The ruling stemmed from WhatsApp's accusation that NSO Group exploited a vulnerability in its audio-calling feature to hack over 1,400 users. The trial revealed NSO Group targeted a U.S. phone number for an FBI test and continued targeting WhatsApp users even after the lawsuit began.

The trial also disclosed that NSO Group's headquarters shares a building with Apple and that the company's government clients don't choose hacking methods. The spyware used a "zero-click" attack, requiring no user interaction.

Source: https://techcrunch.com/2025/05/10/five-things-we-learned-from-whatsapp-vs-nso-group-spyware-lawsuit/

US considers fast-tracking AI data centers, risking environmental impact

The U.S. Department of Energy is considering fast-tracking AI data center construction on federal lands, including the National Renewable Energy Laboratory, raising concerns about environmental impact.

The proposal, spurred by a federal request for information, aims to expedite infrastructure development, potentially bypassing environmental reviews and public input, while also facing criticism for water and energy consumption.

This initiative follows a federal directive to streamline permitting, prompting calls for transparency, community engagement, and safeguards to protect resources and prevent unfair financial burdens on residents.

Cloudflare CEO says AI will kill the web

Cloudflare's CEO warns that AI, particularly zero-click searches, threatens the web's existence as we know it. This shift could fundamentally alter the internet's economic model.

The rise of language models providing direct answers, like ChatGPT, is changing how users access information, potentially reducing website traffic. This trend challenges the web's reliance on search engines and click-throughs for revenue.

This shift raises concerns about the future of content creators and the sustainability of the web's current economic structure. Traditional search engines may need to adapt to survive in this evolving landscape.

Source: https://www.techspot.com/news/107859-cloudflare-ceo-warns-ai-zero-click-internet-killing.html

Wellness companies embrace weight-loss drugs after WeightWatchers' bankruptcy

WeightWatchers declared bankruptcy due to the rising popularity of weight-loss drugs, prompting wellness companies to adapt by embracing these medications.

Telehealth companies, rivals to WeightWatchers, are now facing challenges as regulators crack down on cheaper versions of the weight-loss drugs, impacting their sales. These companies are now looking to partner with brand-name drugmakers.

The shift towards weight-loss drugs is reshaping the wellness industry, with companies like The Vitamin Shoppe and GNC adjusting their offerings to cater to users of these medications.

Tesla's Austin robotaxi launch tests Wood's bullish forecast

Cathie Wood's bullish Tesla investment strategy faces a critical test as the company prepares to launch its robotaxi service in Austin, Texas, this June. Her investment firm, Ark Invest, predicts a nine-fold increase in Tesla's stock price by 2029.

Wood's optimistic outlook relies heavily on Tesla's robotaxi service, which Ark Invest believes will generate the majority of the company's earnings within four years. Tesla's CEO, Elon Musk, aims to quickly scale the service after its Austin debut, facing competition from Waymo and others.

Tesla's stock has declined this year, and the company faces revenue challenges and uncertainty from tariffs. Wood's predictions will be tested as Tesla enters the robotaxi market, potentially validating or disproving her long-term investment thesis.

Source: https://www.fool.com/investing/2025/05/10/its-about-to-be-put-up-or-shut-up-time-for-cathie/

Amazon challenges SpaceX Starlink with satellite launch

Amazon has launched its first batch of 27 operational satellites, marking its initial foray into the satellite internet market and a direct challenge to SpaceX's Starlink. This launch is a significant step in Amazon's Project Kuiper initiative.

The launch, occurring roughly a year behind schedule, is a critical milestone for Amazon as it aims to compete with SpaceX's established Starlink service, which currently has over 7,100 satellites in orbit. Amazon faces a tight deadline from the FCC to deploy half its planned constellation by July 2026.

Amazon's success hinges on rapidly scaling satellite production and launch frequency to meet its FCC obligations and begin "early customer pilots." The company's financial resources and existing infrastructure give it a competitive edge, despite the challenges.

Source: https://www.fool.com/investing/2025/05/10/amazon-launches-27-satellites-challenges-spacex/

US investigates imported planes, parts; tariffs possible

The U.S. government has launched an investigation into imported airplanes and aerospace parts, potentially leading to new tariffs.

The investigation, initiated by the Trump administration, could result in tariffs that negatively impact the aerospace industry, which relies on global suppliers and generates significant trade surpluses. Key parts are often sourced from a limited number of manufacturers.

The aerospace industry is a major exporter, with an estimated $125 billion in exports this year. Companies like Boeing, RTX, and GE Aerospace have expressed concerns about the potential financial impact of tariffs on their operations.

Source: https://www.nytimes.com/2025/05/09/business/trump-tariffs-planes-aviation.html

Google pays Texas $1.4 billion for data collection

Google will pay Texas $1.4 billion to settle claims that it collected user data without proper consent, according to an announcement made Friday.

The settlement resolves claims from 2022 regarding geolocation tracking, incognito search data, and biometric information collected through Google's products and services. Texas's Attorney General stated the agreement sends a message to tech companies that they are not above the law.

The $1.4 billion settlement is the largest amount won by any state in a data-privacy violation settlement with Google. The company stated the agreement settles "old claims" and does not require new product changes.

China's prices fell again in April

China's consumer prices declined for the third consecutive month in April, signaling continued economic challenges.

The consumer price index decreased by 0.1% year-on-year, mirroring the previous month's drop, while the producer price index fell by 2.7%. This indicates persistent deflationary pressures within the Chinese economy.

These figures come amid ongoing trade tensions with the United States, posing challenges for policymakers seeking to stabilize economic growth.

Trump plans to lower US drug prices

President Trump is poised to propose a "most-favored nation" policy next week, aiming to lower U.S. drug prices, potentially disrupting the pharmaceutical industry.

This policy would link U.S. drug payments to prices in other high-income countries, where medications often cost less. The previous Trump administration attempted this, but faced setbacks.

With a majority in both the House and Senate, the current administration may have a better chance of implementing the plan, despite past opposition.

Bessent warns U.S. could default by August

The U.S. government could default on its financial obligations by August if Congress fails to raise the debt ceiling, according to Treasury Secretary Scott Bessent.

Bessent informed congressional leaders Friday that the "X-date," when borrowing power runs out, could arrive by August. He urged action by mid-July to avoid an unprecedented default.

The warning comes as lawmakers are working on a legislative package to enact President Trump's agenda alongside addressing the debt ceiling.

US reviews Benchmark's investment in Chinese AI firm

The U.S. Treasury Department is reviewing Benchmark's investment in Chinese AI startup Manus AI, potentially due to compliance concerns.

The investment, a $75 million round valuing Manus AI at $500 million, is under scrutiny regarding 2023 restrictions on investments in Chinese companies. Benchmark's lawyers initially approved the deal, citing Manus's use of existing AI models and its Cayman Islands incorporation.

Manus AI, a prominent AI agent startup, has drawn criticism for its funding from Benchmark. The Treasury Department, Benchmark, and Manus AI have not yet commented on the review.

Judge will decide Google's search monopoly remedies

The Google search antitrust trial concluded, with the judge now deciding on remedies for the company's illegal monopoly, potentially impacting the search landscape. The ruling, expected in August, could force Google to divest Chrome or license its search technology.

The Department of Justice proposed remedies including a Chrome sale and licensing Google's search index, with potential buyers like OpenAI and Yahoo expressing interest. Google argued these actions would harm privacy, security, and consumer choice, while also facing scrutiny over its deals with Apple and Mozilla.

The trial also addressed Google's AI investments and the evolving search market, with Judge Mehta noting the rapid advancements in AI since the initial trial. Google faces further legal challenges, including appeals related to the Google Play case and an ad tech case.

Starmer wants closer UK-EU trade ties

Prime Minister Keir Starmer announced plans for a closer trading partnership with the EU, urging the public to move past Brexit and focus on future relations.

Starmer indicated the UK would align with the EU on food standards and law enforcement, while also supporting a youth mobility scheme, following recent trade deals with the US and India. This push comes amid concerns about the electoral impact of Reform UK and cautious EU responses.

The government is also willing to pay for UK companies to access EU defense spending programs. Business leaders and the Bank of England hope to rebuild trade relationships, recognizing the economic benefits of closer ties with the EU.

Share this post