Jack’s note:

The Stock Insider SaaS:

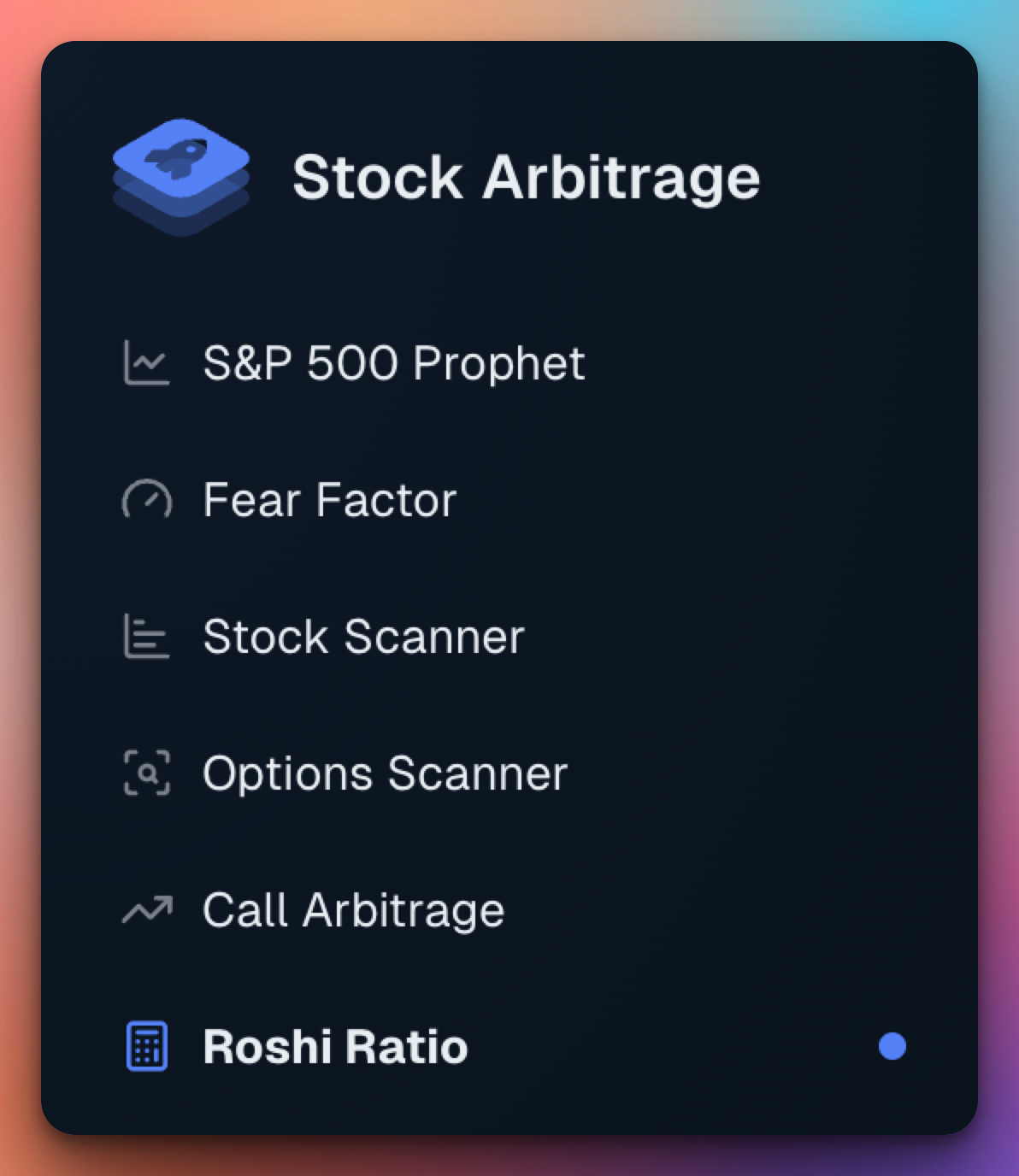

The Stock Arbitrage Scanner is coming out of alpha this week and will be available to all paying and lifetime users.

It will be suitable for both short-, mid- and long-term traders. There will be options too including LEAPs. Everything under 1 roof.

The wait will be worth it.

I will explain more today, including the new Roshi Ratio that I have been working on for months, in today’s Weekly Report.

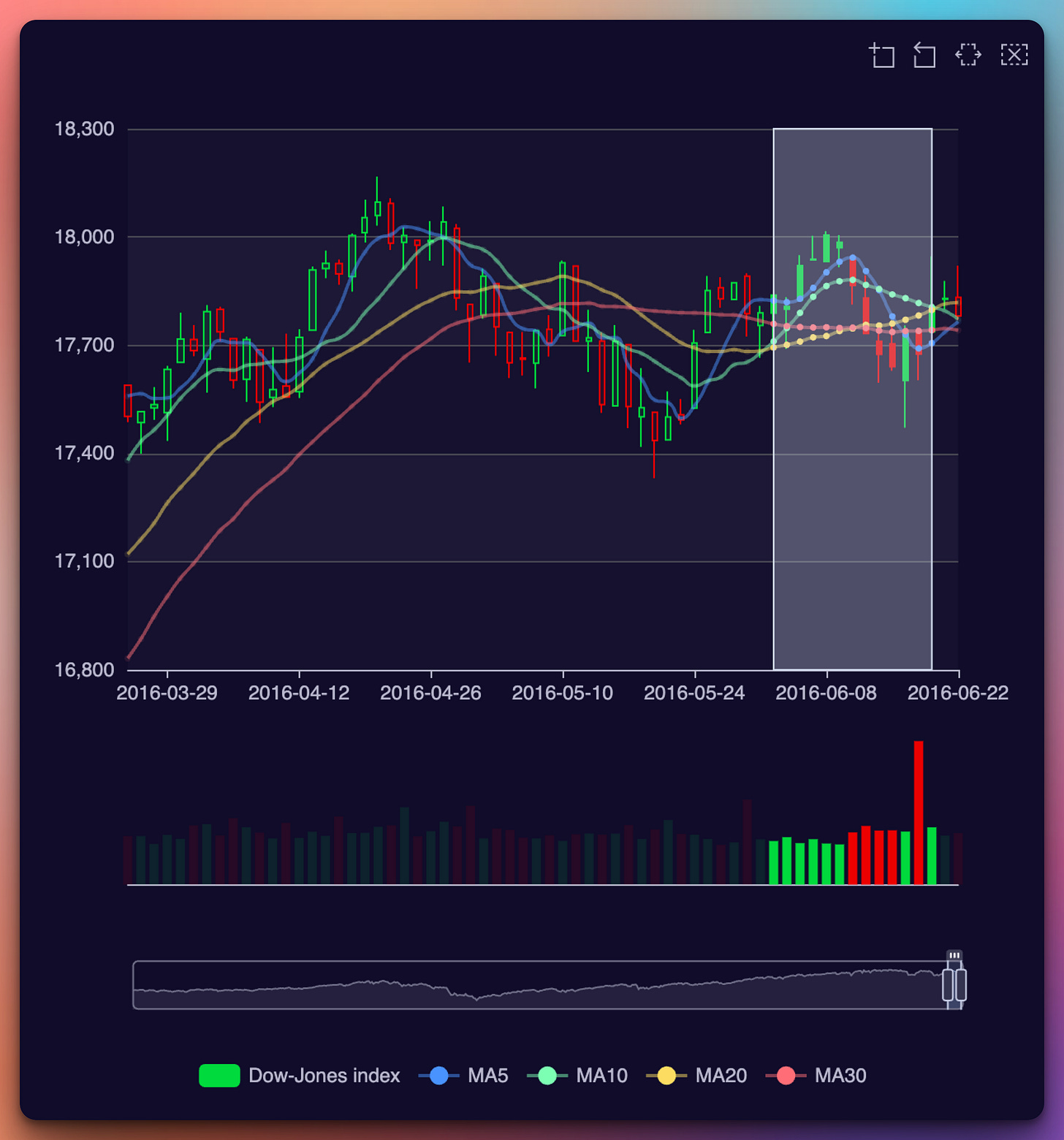

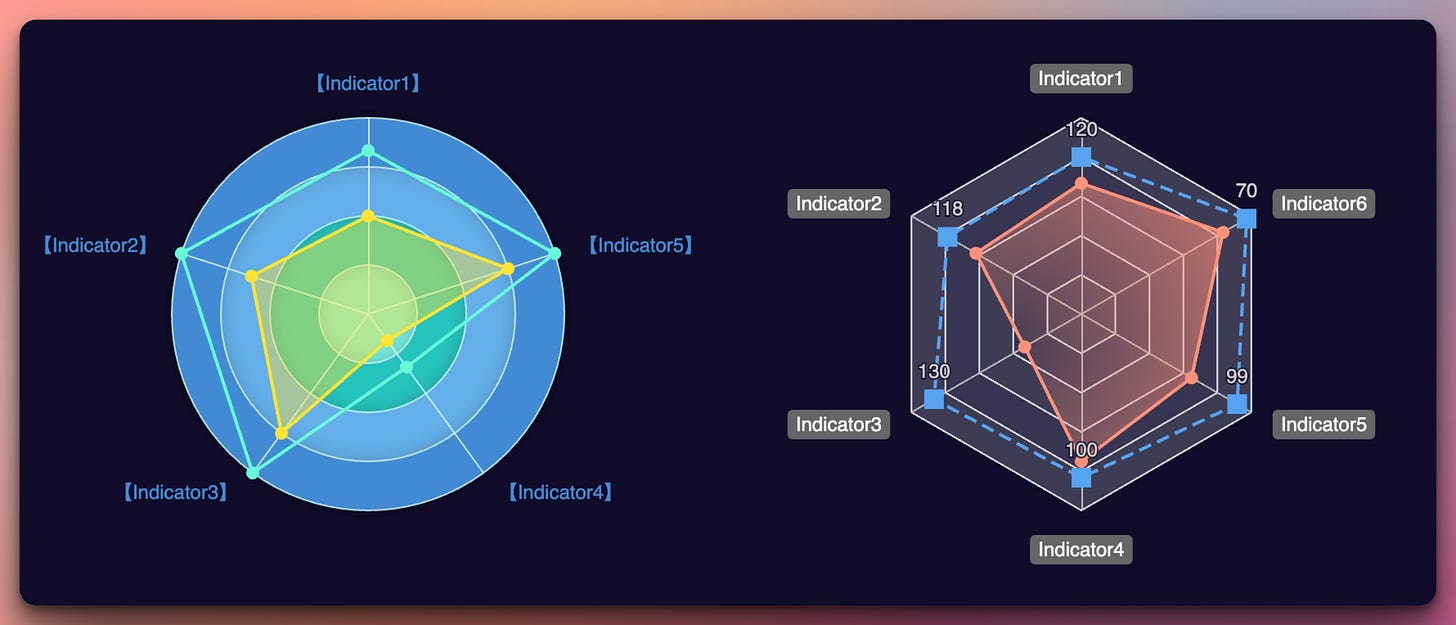

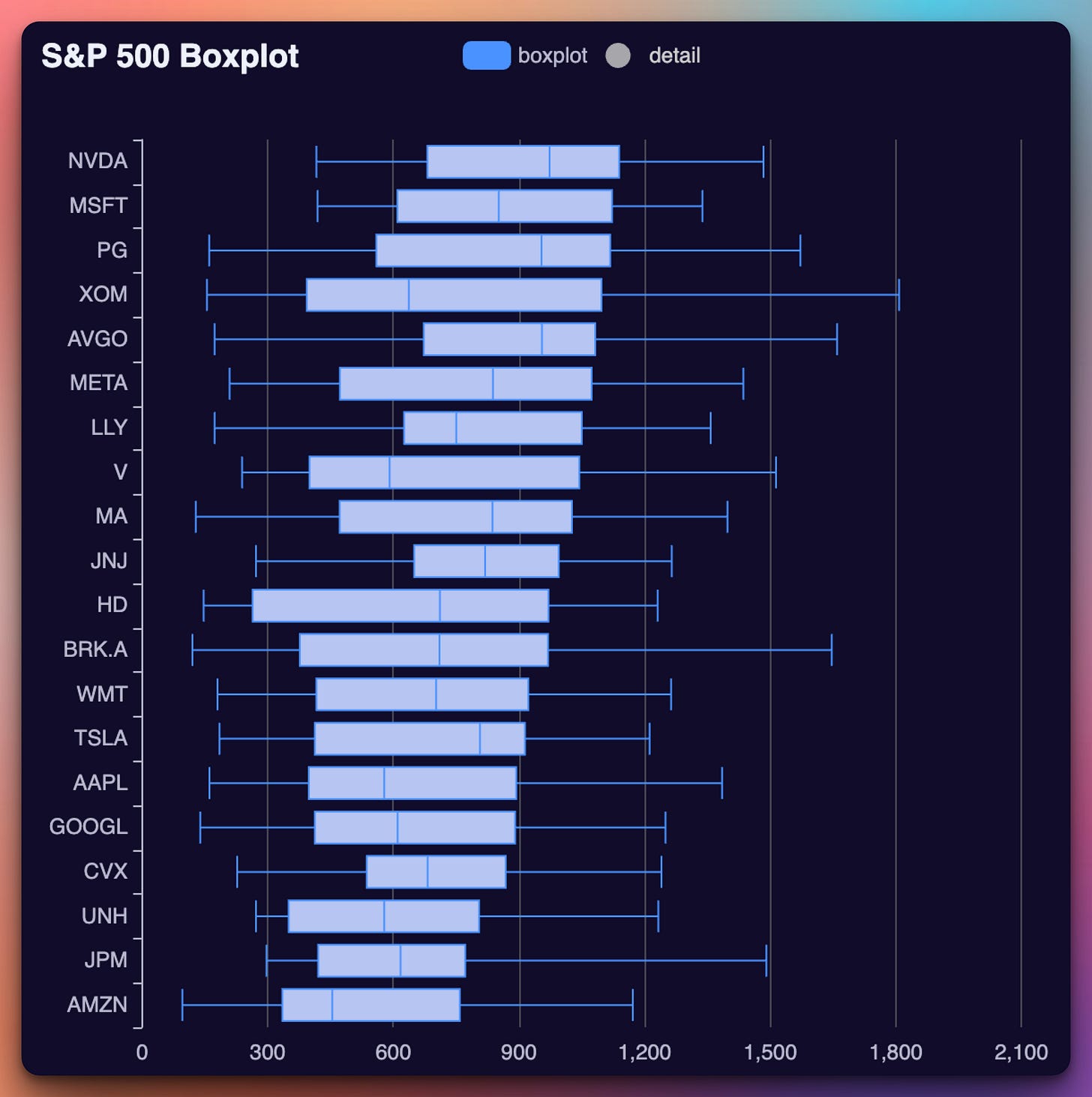

We will have beautiful, interactive charts:

And simple answers for people who don’t want to delve too deep into numbers, candles, and charts:

Lifetime subscriptions are back and, hopefully, here to stay.

Hi!

It’s Jack and the The Stock Insider team with the best non-partisan daily newsletter related to politics, the US stock market, and business. 😇

The Markets:

📉 Fear & Greed Index: 52/100

🟢🟢🟢🔴🔴 — Fear based on VIX

(It’s best to trade when the index is neutral—right in the middle.)

The calculation is based on VIX:

σ² = (2 / T) * Σ[ΔK * (K^(-2)) * e^(RT) * Q(K)] - (1 / T) * [(F / K0) - 1]²

Where:

- T is the time to expiration in years.

- ΔK is the interval between strike prices.

- K is the strike price of the option.

- R is the risk-free interest rate.

- Q(K) is the midpoint of the bid-ask spread for each option with strike K.

- F is the forward index level derived from index option prices.

- K0 is the first strike below the forward index level F.Index Futures

Equity benchmarks advanced, led by small caps, while European and Mexican indices showed mixed performance.

🟢 Small Cap 2000: 2,020.74 (+44.88 | +2.27%)

🟢 Nasdaq: 17,977.73 (+266.99 | +1.51%)

🟢 S&P 500: 5,686.67 (+82.53 | +1.47%)

🟢 Dow Jones: 41,317.43 (+564.47 | +1.39%)

🟢 FTSE 100: 8,596.35 (+99.55 | +1.17%)

🟢 S&P/TSX: 25,031.51 (+235.96 | +0.95%)

🟢 DAX: 23,262.92 (+205.58 | +0.89%)

🟢 Bovespa: 135,134 (+67 | +0.05%)

🔴 Euro Stoxx 50: 5,272.05 (–13.14 | –0.25%)

🔴 CAC 40: 7,724.60 (–45.88 | –0.59%)

🔴 S&P/BMV IPC: 55,811.99 (–447.29 | –0.80%)

🔴 MSCI World: 3,723.45 (–1.17 | –0.03%)

Forex & Bonds

U.S. Treasury yields climbed sharply; the dollar weakened against major currencies while Bitcoin saw modest gains.

🟢 5-Year Treasury: 3.932 (+0.121 | +3.18%)

🟢 10-Year Treasury: 4.322 (+0.091 | +2.15%)

🟢 30-Year Treasury: 4.795 (+0.058 | +1.22%)

🟢 EUR/USD: 1.1349 (+0.0050 | +0.45%)

🟢 GBP/USD: 1.3323 (+0.0055 | +0.41%)

🟢 BTC/USD: 94,154.30 (+154.30 | +0.16%)

🔴 USD/JPY: 143.82 (–1.13 | –0.78%)

Major News

Tech and growth names led gains; AAPL fell sharply on profit-miss concerns.

🟢 PLTR: +6.95%

🟢 AVGO: +3.20%

🟢 NVDA: +2.59%

🟢 TSLA: +2.38%

🟢 MSFT: +2.32%

🟢 JPM: +2.28%

🟢 NFLX: +2.03%

🟢 GOOG: +1.86%

🟢 BRK-B: +1.80%

🟢 BRK-A: +1.75%

🟢 GOOGL: +1.69%

🟢 SPY: +1.48%

🟢 QQQ: +1.48%

🟢 VOO: +1.43%

🔴 AMZN: –0.12%

🔴 AAPL: –3.74%

Below, you can subscribe to my most significant newsletter (almost HALF A MILLION active retail traders). I publish A TON of free articles there.

Most Interesting Events:

Macro Data

09:45 ET S&P Global U.S. Services & Composite PMI (final April). Flash reading signalled activity cooling under tariff pressure; final print can revise the narrative on services resilience.

10:00 ET ISM Services PMI (April). Consensus near the 50-line; price-paid and employment sub-indexes guide margin outlook and Fed-watchers.

Federal Reserve

FOMC two-day policy meeting starts. Deliberations on rates and balance-sheet run-off begin under blackout; curve repricing can start ahead of Wednesday’s statement and projections.

U.S. Treasury Operations

Preliminary cash-management buy-back notice expected around 11:00 ET.

11:30 ET 13- & 26-week bill auctions set front-end collateral yields.

13:00 ET $58 bn new 3-year note auction tests dealer risk appetite in the belly.

Earnings Flow

Before the open

Cummins, Ares, BioNTech, Zimmer Biomet, Tyson, ON Semiconductor, CNA Financial, Henry Schein, TG Therapeutics, JBT Marel, Axsome, Freshpet.

After the close / evening

Paymentus (17:00 ET), SiriusPoint (~16:00 ET), TrueBlue (17:00 ET), Addus, Recursion, EverQuote, FreightCar America, Weave, Ford (16:05 results, 17:00 call).

Corporate Actions

Reverse splits effective today

NewGen IVF Group (NGIVF) 1-for-10.

Top KingWin Ltd (TC) 1-for-25.

Ticker change DeFi Development Corp. begins trading as DFDV on Nasdaq.

Legal / Policy

Supreme Court order list 09:30 ET. Cert grants or denials in antitrust, environmental, or crypto cases can spark single-name moves.

Consumer & Commodities

Cinco de Mayo on-premise beer and spirits demand spikes; Constellation Brands volumes watched for tariff drag.

Weekend OPEC+ decision to accelerate June supply (+411 kbpd) knocked Brent under $61; energy equities open against weaker crude.

Overnight Backdrop

Asia-holiday-thinned risk-off tone, dollar softness on Taiwan dollar surge, and oil slide framed futures before the U.S. bell while participants await Fed and ISM prints.

Sources

Beyond the Paywall:

Most Promising Stocks of The Day (from my new revolutionary Stock Arbitrage Scanner, to be public soon)

Most Impactful News Summaries (with sources)

Listen to this episode with a 7-day free trial

Subscribe to Anti-Clickbait News to listen to this post and get 7 days of free access to the full post archives.